Hollow Glass Market Summary

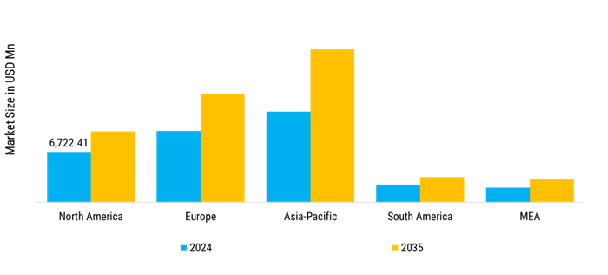

As per Market Research Future analysis, the Hollow Glass Market Size was estimated at 32,712.46 USD Million in 2024. The Hollow Glass industry is projected to grow from 33,922.83 USD Million in 2025 to 50,901.76 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.1% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Hollow Glass Market is witnessing steady growth driven by rising demand from food & beverage, pharmaceuticals, cosmetics, and specialty packaging industries.

- Increasing preference for glass packaging over plastics is supported by sustainability goals, recyclability advantages, and growing regulatory pressure on single-use plastics.

- Demand for lightweight and high-strength glass containers is increasing, driven by transportation cost reduction, carbon footprint optimization, and improved furnace technologies.

- Growing consumption of alcoholic beverages, non-alcoholic drinks, and processed foods is fuelling demand for bottles and jars across emerging and developed economies.

- Pharmaceutical and cosmetic sectors are driving demand for high-purity, chemically resistant hollow glass containers with enhanced barrier and aesthetic properties.

Market Size & Forecast

| 2024 Market Size | 32,712.46 (USD Million) |

| 2035 Market Size | 50,901.76 (USD Million) |

| CAGR (2025 - 2035) | 4.1% |

Major Players

Owens-Illinois, Ardagh Group S.A, Verallia, Sisecam, Vetropack Group, PGP Glass, Saverglass, Zignago Vetro, PauPack, Kandil, Razi Glass Group (Takestan Packaging Glass), Isanti Glass, Saudi Arabian Glass Company (SAGCO), National Factory for Glass Bottles (Zoujaj), Beijing Glass Group Corporation, Middle East Glass (MEG)