Growing Focus on Energy Efficiency

The emphasis on energy efficiency in industrial processes is becoming a crucial driver for the Hollow Fiber Membrane Market. Membrane filtration technologies, particularly hollow fiber membranes, are known for their low energy consumption compared to traditional separation methods. Industries are increasingly seeking solutions that not only reduce operational costs but also minimize their environmental footprint. Reports suggest that energy-efficient technologies in water treatment can lead to savings of up to 30% in energy costs. This trend is likely to encourage more industries to adopt hollow fiber membranes, thereby boosting their market presence and contributing to sustainable practices.

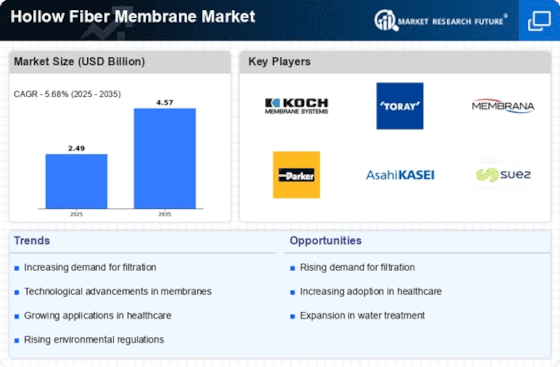

Advancements in Membrane Technology

Technological innovations in membrane manufacturing are significantly influencing the Hollow Fiber Membrane Market. Recent advancements have led to the development of membranes with enhanced permeability and selectivity, which improve their performance in various applications, including desalination and wastewater treatment. The introduction of new materials, such as polymeric and ceramic membranes, has expanded the range of operational conditions under which these membranes can function effectively. Market data indicates that the membrane technology sector is expected to witness a growth rate of around 8% annually, driven by these innovations. As a result, the hollow fiber membrane segment is likely to benefit from increased adoption across diverse industries.

Expansion of Healthcare Applications

The healthcare sector's growing reliance on advanced filtration technologies is emerging as a significant driver for the Hollow Fiber Membrane Market. Hollow fiber membranes are increasingly utilized in medical applications, such as dialysis and blood filtration, due to their superior performance in separating biological fluids. The healthcare industry is projected to expand at a rate of approximately 6% annually, driven by the rising prevalence of chronic diseases and the need for effective treatment solutions. This expansion is likely to create new opportunities for hollow fiber membranes, as they play a critical role in ensuring patient safety and improving treatment outcomes.

Rising Demand for Water Treatment Solutions

The increasing The Hollow Fiber Membrane Industry. As populations grow and industrial activities expand, the need for effective water treatment solutions intensifies. Hollow fiber membranes are recognized for their efficiency in removing contaminants and pathogens from water, making them essential in municipal and industrial water treatment applications. According to recent data, the water treatment sector is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is likely to propel the demand for hollow fiber membranes, as they offer a cost-effective and reliable solution for ensuring water quality and safety.

Increasing Regulatory Pressure for Water Quality

Regulatory frameworks aimed at ensuring water quality and safety are becoming more stringent, which is positively impacting the Hollow Fiber Membrane Market. Governments and environmental agencies are implementing regulations that mandate the use of advanced filtration technologies in water treatment processes. This regulatory pressure is driving industries to adopt hollow fiber membranes, which are effective in meeting compliance standards for water quality. Market analysis indicates that the regulatory landscape is expected to evolve, with more countries adopting similar measures. Consequently, this trend is likely to enhance the demand for hollow fiber membranes as industries strive to adhere to these regulations.