Research Methodology on HIV Drugs Market

Introduction

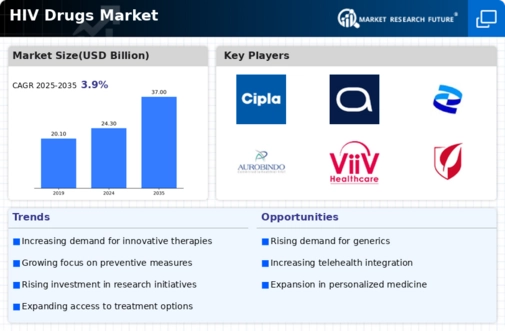

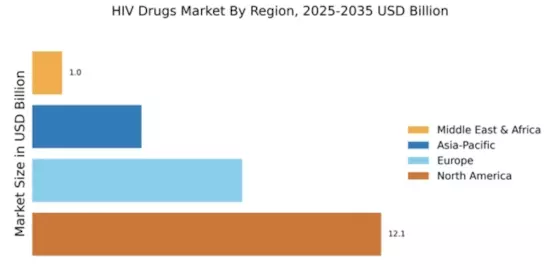

The Human Immunodeficiency Virus (HIV) Drugs Market report provides an in-depth analysis of the global market to present a comprehensive assessment of the growth trends, dynamics, and geographical segmentation. It comprises an exhaustive evaluation of the current landscape, market discussions, and competitive influence. The report is ideal for anyone looking for an up-to-date and detailed view of the HIV drug landscape.

The Human Immunodeficiency Virus (HIV) Drugs Market covers the forecast period from 2023 to 2030 while evaluating the drivers, restraints, advantages, and limitations influencing the market growth. The report also highlights the key developments and competitive strategies adopted by these players in the pharmaceutical market. Furthermore, the report discusses emerging trends, and strategies used, as well as provides comprehensive forecast data from 20233 to 2030.

Research Methodology

The research methodology adopted for this study entails both primary and secondary research techniques. these techniques include but are not limited to focus groups, interviews, questionnaires, market surveys, and industry reports. Extensive primary and secondary research is conducted to establish the market size and market forecast. The research methodology aims to gain substantial insights from the research study. Detailed secondary research sources are used to formulate key industry insights and their implications on the market.

The primary research includes one-to-one interviews with industry experts, key opinion leaders, market participants, and decision-makers. Data is collected from various sources such as industry events and conferences, press releases and public documents, industry interviews, surveys and questionnaires, subscription and syndicate analyst report services, as well as other sources such as governmental and academic organizations.

The primary research sources provide detailed information on the market dynamics and provide a better understanding of the market dynamics. It also helps in understanding the trends and drivers influencing market trends, product features, and key business strategies. Furthermore, focus groups and seminars are conducted to get a better understanding of the current market scenario.

In the secondary research step, the findings derived from primary research are further substantiated. Extensive research sources such as clinical trials, government websites, as well as conference proceedings, trade magazines, and databases are used. These sources are used to get a clear perspective on the market dynamics and also to assess the impact of various factors on the market development.

These analyses include data triangulation methods, such as quantitative and qualitative methods, as well as an analysis of the competitive landscape, in which market players are compared based on their market share, financial performance, revenue, product offerings, brand strength, corporate strategy, partnerships, and initiatives taken. Additionally, detailed market segmentation is conducted with the help of advanced analytical tools, and available statistics are polished and curated to deliver detailed market analysis and insights.

The market data is acquired from the analysis of various industry sources such as economic surveys, company annual reports, market forecasts, and various other industry reports and analyses. It helps ensure that the market size and forecast are accurate and reliable. Furthermore, market size and forecast data are available in both qualitative and quantitative analysis.

Results and Analysis

The research findings are analyzed and presented in the Human Immunodeficiency Virus (HIV) Drugs Market report. The findings from primary and secondary research along with industry analysis are discussed in detail for both qualitative and quantitative measurements. The report covers the impact of various market dynamics such as drivers, restraints, trends, and competitive dynamics.

The report also provides an in-depth analysis of market segmentation. It discusses the key market players and their product offerings in the Human Immunodeficiency Virus Drugs Market. It also provides comprehensive industry developments including strategies, product offerings, brands, partnerships and collaborations. In addition, the report also provides insights into consumer behaviour and their preferences for HIV drugs.

Conclusion

The HIV Drugs Market report provides a comprehensive assessment of the market, taking into consideration the impact of the COVID-19 pandemic on the industry. The report provides an in-depth analysis of the key market trends, drivers, opportunities, competitive strategies, and segments. The report is expected to serve as a valuable tool for clients looking to make informed decisions about their investments in the HIV drugs industry.