Growing Geriatric Population

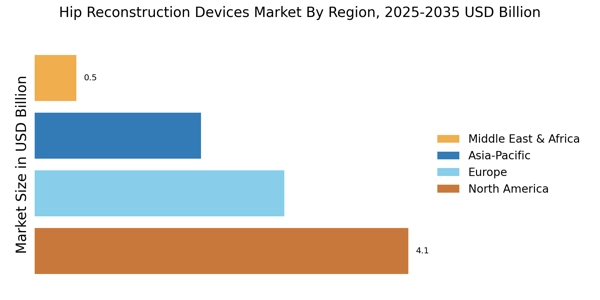

The expanding geriatric population is a crucial factor driving the Hip Reconstruction Devices Market. As individuals age, the likelihood of developing hip-related ailments escalates, necessitating surgical interventions. By 2030, it is estimated that the number of people aged 65 and older will surpass 1 billion, significantly impacting healthcare systems worldwide. This demographic shift is likely to result in an increased demand for hip reconstruction surgeries, thereby boosting the market for related devices. Healthcare providers are increasingly focusing on addressing the needs of this population, which further emphasizes the relevance of the Hip Reconstruction Devices Market in contemporary healthcare.

Increased Healthcare Expenditure

Rising healthcare expenditure across various regions is fostering growth in the Hip Reconstruction Devices Market. Governments and private sectors are investing more in healthcare infrastructure, leading to improved access to surgical procedures and advanced medical technologies. Data suggests that healthcare spending is expected to grow at a compound annual growth rate of 5% over the next five years. This increase in funding allows for the procurement of state-of-the-art hip reconstruction devices, enhancing surgical capabilities and patient outcomes. Consequently, the financial commitment to healthcare is a pivotal driver of the Hip Reconstruction Devices Market.

Rising Incidence of Hip Disorders

The increasing prevalence of hip disorders, including osteoarthritis and hip fractures, is a primary driver of the Hip Reconstruction Devices Market. As populations age, the incidence of these conditions rises, leading to a greater demand for effective surgical interventions. According to recent data, the number of hip replacement surgeries is projected to reach approximately 3 million annually by 2030. This surge in surgical procedures necessitates advanced hip reconstruction devices, thereby propelling market growth. Furthermore, the growing awareness of treatment options among patients and healthcare providers contributes to the rising demand for innovative solutions in the Hip Reconstruction Devices Market.

Technological Advancements in Device Design

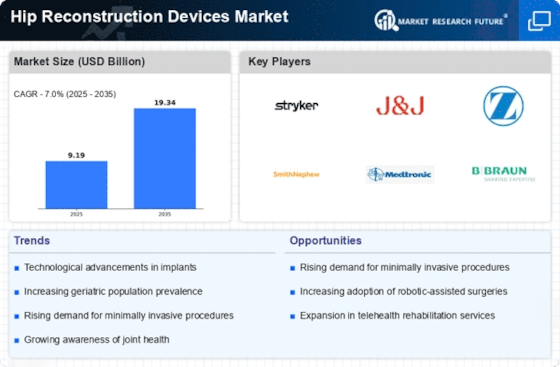

Technological innovations in the design and manufacturing of hip reconstruction devices are significantly influencing the Hip Reconstruction Devices Market. The introduction of advanced materials, such as biocompatible polymers and enhanced metal alloys, has improved the durability and performance of these devices. Additionally, the development of 3D printing technology allows for customized implants tailored to individual patient anatomies, enhancing surgical outcomes. Market data indicates that the adoption of these technologies is expected to increase, with a projected growth rate of over 8% in the next five years. This trend underscores the importance of continuous innovation in the Hip Reconstruction Devices Market.

Emphasis on Rehabilitation and Postoperative Care

The growing emphasis on rehabilitation and postoperative care is shaping the Hip Reconstruction Devices Market. Enhanced recovery protocols and rehabilitation programs are becoming integral to the surgical process, ensuring better patient outcomes and satisfaction. As healthcare providers recognize the importance of comprehensive care, there is a corresponding increase in the demand for devices that facilitate recovery. Market analysis indicates that the integration of rehabilitation technologies, such as wearable devices and telehealth solutions, is likely to expand, further driving the Hip Reconstruction Devices Market. This focus on holistic patient care underscores the evolving landscape of hip reconstruction.