Rising Regulatory Standards

The High Volume Dispensing Systems Market is significantly influenced by the increasing regulatory standards imposed by various governing bodies. These regulations are primarily aimed at ensuring safety, quality, and environmental compliance in manufacturing processes. For instance, the pharmaceutical sector is subject to stringent guidelines that necessitate precise dispensing of substances, thereby driving the demand for advanced dispensing systems. As companies strive to adhere to these regulations, investments in high volume dispensing technologies are expected to rise. This trend is further supported by the need for traceability and accountability in production processes, which high volume dispensing systems can effectively provide. Thus, the evolving regulatory landscape is a critical driver for the growth of the High Volume Dispensing Systems Market.

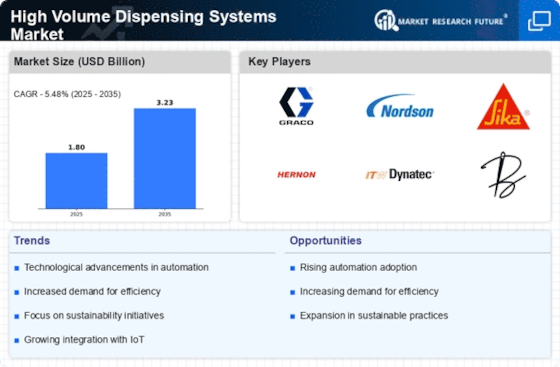

Increased Demand for Automation

The High Volume Dispensing Systems Market is experiencing a notable surge in demand for automation across various sectors. Industries such as pharmaceuticals, food and beverage, and chemicals are increasingly adopting automated dispensing systems to enhance efficiency and reduce labor costs. According to recent data, the automation trend is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This shift towards automation not only streamlines operations but also minimizes human error, thereby improving product quality and consistency. As companies strive to meet rising consumer expectations for speed and accuracy, the integration of high volume dispensing systems becomes essential. Consequently, this driver is likely to shape the future landscape of the High Volume Dispensing Systems Market.

Growth in E-commerce and Online Retail

The High Volume Dispensing Systems Market is witnessing a transformative impact due to the rapid growth of e-commerce and online retail. As consumer preferences shift towards online shopping, businesses are compelled to enhance their logistics and distribution capabilities. High volume dispensing systems play a pivotal role in optimizing inventory management and order fulfillment processes. Recent statistics indicate that e-commerce sales are expected to reach unprecedented levels, necessitating efficient dispensing solutions to meet consumer demand. This trend is particularly evident in sectors such as cosmetics and personal care, where high volume dispensing systems facilitate quick and accurate product delivery. Consequently, the expansion of e-commerce is likely to drive the adoption of high volume dispensing systems, thereby propelling the market forward.

Focus on Cost Efficiency and Waste Reduction

The High Volume Dispensing Systems Market is increasingly driven by the focus on cost efficiency and waste reduction. Companies across various sectors are under constant pressure to optimize their operations and minimize expenses. High volume dispensing systems offer a solution by enabling precise dispensing, which reduces material waste and lowers production costs. Recent analyses suggest that businesses implementing these systems can achieve cost savings of up to 20% in their dispensing processes. Additionally, as sustainability becomes a priority for many organizations, the ability to reduce waste aligns with broader environmental goals. This dual focus on cost efficiency and sustainability is likely to enhance the attractiveness of high volume dispensing systems, thereby fostering growth within the market.

Technological Innovations in Dispensing Systems

The High Volume Dispensing Systems Market is significantly propelled by ongoing technological innovations. Advancements in areas such as IoT, AI, and machine learning are revolutionizing the capabilities of dispensing systems. These technologies enable real-time monitoring, predictive maintenance, and enhanced data analytics, which contribute to improved operational efficiency. For instance, IoT-enabled dispensing systems can provide valuable insights into usage patterns, allowing companies to optimize their inventory levels. Furthermore, the integration of AI can enhance the accuracy of dispensing processes, reducing waste and increasing productivity. As industries continue to seek competitive advantages through technology, the demand for innovative high volume dispensing systems is expected to rise. This trend underscores the importance of technological advancements as a key driver in the High Volume Dispensing Systems Market.