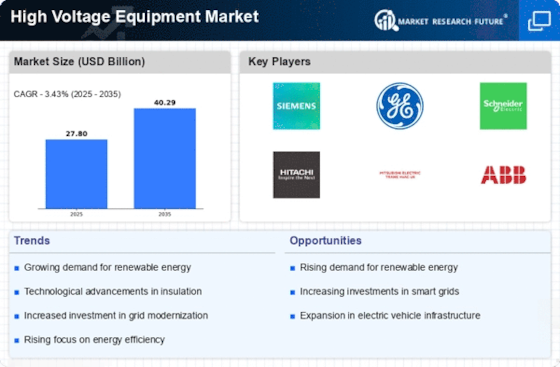

Rising Demand for Electricity

The increasing demand for electricity across various sectors is a primary driver for the High Voltage Equipment Market. As urbanization and industrialization continue to expand, the need for reliable and efficient power transmission becomes paramount. According to recent data, electricity consumption is projected to rise by approximately 2.5% annually, necessitating the enhancement of existing infrastructure. This surge in demand compels utilities and energy providers to invest in high voltage equipment to ensure stable supply and minimize transmission losses. Consequently, the High Voltage Equipment Market is likely to experience substantial growth as stakeholders seek to upgrade their systems to meet the escalating energy requirements.

Government Regulations and Standards

Government regulations and standards play a crucial role in shaping the High Voltage Equipment Market. Regulatory bodies are increasingly enforcing stringent safety and environmental standards, compelling manufacturers to innovate and comply with these requirements. For instance, regulations aimed at reducing carbon emissions and enhancing energy efficiency are driving the adoption of high voltage equipment that meets these criteria. This regulatory landscape is expected to foster competition among manufacturers, leading to advancements in technology and product offerings. Consequently, the High Voltage Equipment Market is likely to witness growth as companies adapt to these evolving standards and invest in compliant high voltage solutions.

Investment in Smart Grid Technologies

The transition towards smart grid technologies is significantly influencing the High Voltage Equipment Market. Smart grids facilitate improved energy management, efficiency, and reliability, which are essential in modern power systems. Investments in smart grid infrastructure are expected to reach billions in the coming years, driven by the need for enhanced grid resilience and integration of distributed energy resources. This shift not only optimizes electricity distribution but also reduces operational costs for utilities. As a result, the High Voltage Equipment Market is poised to benefit from the demand for advanced high voltage equipment that supports smart grid functionalities, thereby enhancing overall system performance.

Integration of Renewable Energy Sources

The integration of renewable energy sources into the power grid is a significant driver for the High Voltage Equipment Market. As countries strive to meet sustainability goals, the incorporation of wind, solar, and hydroelectric power is becoming increasingly prevalent. This transition necessitates the use of high voltage equipment to manage the variable nature of renewable energy generation and ensure stable grid operations. Market data indicates that investments in renewable energy infrastructure are expected to exceed trillions over the next decade, further propelling the demand for high voltage equipment. Thus, the High Voltage Equipment Market stands to gain from the growing emphasis on renewable energy integration and the associated technological advancements.

Technological Innovations in Equipment Design

Technological innovations in equipment design are transforming the High Voltage Equipment Market. Advances in materials science, digitalization, and automation are leading to the development of more efficient and reliable high voltage equipment. Innovations such as smart transformers and advanced circuit breakers are enhancing operational efficiency and reducing maintenance costs. Furthermore, the adoption of digital technologies allows for real-time monitoring and predictive maintenance, which can significantly extend the lifespan of high voltage equipment. As these technologies continue to evolve, the High Voltage Equipment Market is likely to experience increased demand for cutting-edge solutions that improve performance and reliability in power transmission.