Market Trends

Key Emerging Trends in the High Voltage Amplifier Market

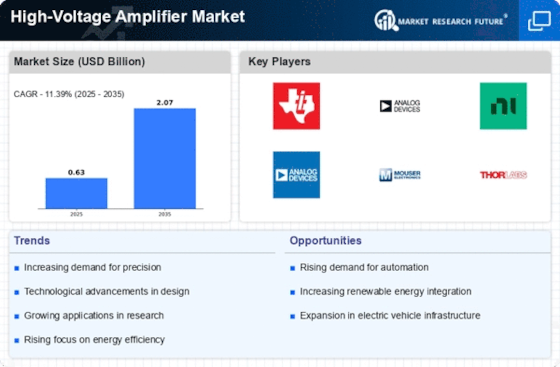

Today's high-voltage amplifier markets have been influenced by several significant trends that shape the landscape. As medical technology continues to develop, it, among other things, requires appliances providing precise outputs that are reliable at higher voltages needed for applications like diagnostic imaging or therapeutic devices. One of these is an increase in demand for solar energy-based installations using HVs throughout the world. Another important trend is also seen in the growing interest in renewable energy sources, which require amplifiers capable of supporting solar panels, among others. As a consequence, this increases the uptake of electricity produced from nuclear power plants. It means, therefore, that the subset is very large due to its ability to generate tremendous power. There are several reasons why political instability affects output in general. For example, political instability affects FDI inflow. Export revenues from oil exports increased, whereas wages declined, leading to a gap between the rich-poor The High Voltage Amplifier industry has experienced many notable market trends that have had an impact on its current state. This includes the rising significance of high-voltage amplifiers used in medical equipment. Simultaneously, they may run systems that utilize photovoltaic cells. Other major trends include the increasing demand for solar panels and the growth of renewable energy sources, among others. Because of this, there was an increase in electricity consumption from the nuclear power plants. This means that a lot of people like to have a huge amount of energy in one area. Most often, political instability has been cited as the main reason causing economic downturns, yet these factors are "within the FDI inflow." Political riskiness is one of the reasons why the wages of employees fall, and it improves export income coming in from petroleum, which creates some disparity between wealthy and poor citizens. Miniaturization has also become a prominent trend in the high-voltage amplifier market. The overall trend has been to make devices smaller and more compact; hence, there is increased demand for HV amplifiers with higher performance packed into small form factors. Besides, improved efficiency and energy conservation are also emerging trends in this market segment. Hence, brands are now focused on making high-voltage amplifiers that are not only powerful but also consume less power. In addition, there has been a shift to advanced materials in the design of amplifiers. The use of custom-made amplifiers by industries is another trend witnessed in High Voltage Amplifier markets today, as shown by customer preferences. As a result, manufacturers will offer flexible solutions so that customers can pick specific features or specifications that fit their exact needs.

Leave a Comment