Market Analysis

In-depth Analysis of High Temperature Composite Resin Market Industry Landscape

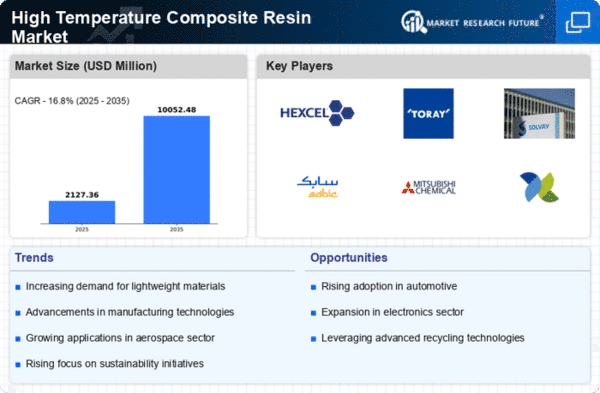

The high-temperature composite resin market is a dynamic landscape shaped by a myriad of factors, influencing its growth, trends, and challenges. Composite resins, renowned for their ability to withstand extreme temperatures, find applications in diverse industries like aerospace, automotive, and electronics. The market dynamics are intricately linked to technological advancements, demand-supply fluctuations, and evolving consumer preferences.

One of the pivotal drivers of this market is the relentless pursuit of innovation. Manufacturers are continually investing in research and development to engineer resin formulations capable of withstanding higher temperatures while maintaining structural integrity. These advancements not only enhance the performance of composite materials but also expand their applicability in demanding environments such as aerospace engine components and high-performance automotive parts.

Moreover, the burgeoning demand for lightweight and fuel-efficient materials across industries propels the growth of high-temperature composite resins. Aerospace and automotive sectors, in particular, are increasingly adopting composite materials due to their exceptional strength-to-weight ratio, which contributes to fuel savings and reduces carbon emissions. This surge in demand necessitates a consistent and reliable supply chain, prompting manufacturers to optimize production capacities and streamline distribution networks.

However, the market dynamics are not without their challenges. Fluctuating raw material prices pose a significant challenge to manufacturers, impacting production costs and profit margins. Volatile petroleum prices, as composite resins are primarily derived from petrochemicals, can disrupt the cost structure and influence pricing strategies within the market. To counteract this, companies often engage in strategic partnerships and long-term contracts with suppliers to mitigate raw material price fluctuations.

Additionally, stringent regulatory frameworks and environmental concerns shape the market dynamics. There is an increasing emphasis on sustainability, prompting manufacturers to develop eco-friendly composite resin formulations that minimize environmental impact without compromising performance. Compliance with regulatory standards and certifications becomes a crucial aspect influencing market penetration and consumer trust.

Furthermore, global economic conditions and geopolitical factors play a pivotal role in market dynamics. Economic downturns or geopolitical tensions can significantly impact the demand for high-temperature composite resins across industries, leading to fluctuations in market growth. The pandemic-induced disruptions highlighted the vulnerability of global supply chains, prompting companies to reassess and diversify their sourcing strategies to ensure resilience in the face of unforeseen crises.

The market dynamics of high-temperature composite resins also witness influences from shifting consumer preferences and industry trends. Increasing focus on electric vehicles, renewable energy, and emerging technologies like additive manufacturing further diversifies the applications of composite materials, driving innovation and market expansion.

Leave a Comment