Market Analysis

In-depth Analysis of High Temperature Coatings Market Industry Landscape

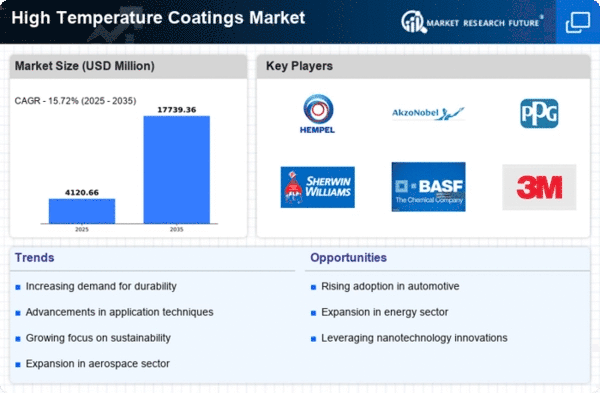

The dynamics of such high-temperature coatings are determined mainly by multi-faced factors specifically demand, trajectory and competitive stance. High-temperature coatings are specially made to bear the extremes of heat, making it imperative in industries such as automotive, aerospace, oil and gas, and manufacturing. The strongest factor that is making the high-temperature paint market grow fast is the rising need for materials that can give excellent thermal insulation from corrosion, oxidation, and thermal destructivity at high temperatures. Theses coatings perform a very important task of making the longevity and efficacy of those components which are subjected to high temperatures (for instance, engine parts, exhaust systems, and industrial equipment) better.

The automotive and aerospace industry are the key market levers in the high temperature coating market. The industry is facing new demands as regards the fuel economy and engine performance. Manufacturers need coating materials with great resistance to high temperatures in the engines and exhaust systems. High-temperature coatings not only fight against wearing but also extend the service life of the crucial parts which are required to meet the industry-specific demanding conditions. With the development of the automotive and aerospace industries, the demand for high-temperature coatings is forecasted to remain as strong as previously.

Along with the economy fact, such as raw materials prices and production costs, influencing the high-temperature coating market is another significant factor. The price of the raw materials like resins and pigments may change sometimes which can make an impact on the overall production cost and packaging rates. The manufacturers periodically take stock of these economic factors in making their decisions, guaranteeing a competitive market and sustained growth in the high-temperature coatings industry.

The high-temperature coating market changes as a consequence of technology development. Technology is one of the elements of moving forward. New formulas, application methods and nanomaterials are constantly being developed by research and development processes and are aimed at increasing the efficiency and durability of the high temperature coatings. The continuous innovation is governed by the achievements like the ceramic matrix composites and the coating with enhanced thermal barrier properties that offers solutions addressing high temperature application to manufacturers.

The competitive landscape of the high-temperature coatings market is widely spread out through strategic partnerships, mergers, and acquisitions that take place among key market competitors. Alliance is an opportunity for companies to build on each other’s strong points, share expertise, and grow an array of their products. Strategic actions provide a boost for innovations, thus helping the industry to mature.

Leave a Comment