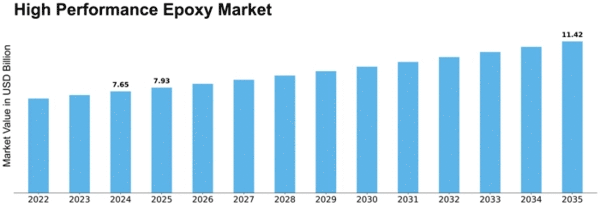

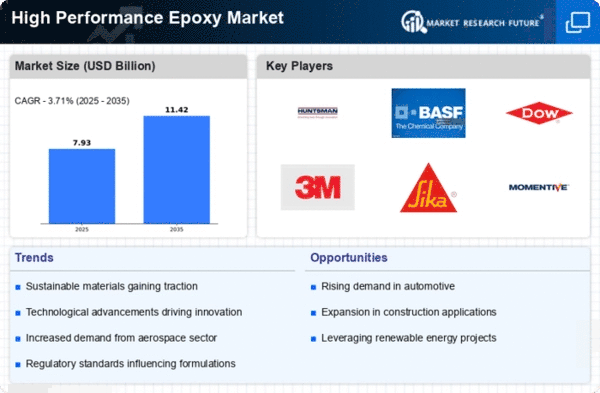

Market Growth Projections

The Global High Performance Epoxy Market Industry is poised for substantial growth, with projections indicating a market value of 9.51 USD Billion in 2024 and an anticipated increase to 18.1 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 6.0% from 2025 to 2035, driven by various factors such as rising demand in automotive and aerospace sectors, technological advancements, and increasing infrastructure development. The market's expansion suggests a robust future for high performance epoxies, as industries continue to seek innovative solutions to meet their evolving needs.

Growth in Aerospace Applications

The aerospace industry significantly contributes to the expansion of the Global High Performance Epoxy Market Industry. High performance epoxies are utilized in aircraft manufacturing due to their lightweight properties and exceptional strength-to-weight ratios. These materials are crucial for components such as wings, fuselage, and interior structures, where performance and safety are paramount. The increasing demand for fuel-efficient aircraft is likely to propel the market forward, with projections indicating a market value of 18.1 USD Billion by 2035. This growth suggests a robust future for high performance epoxies in aerospace, as manufacturers seek to enhance performance while adhering to stringent regulatory standards.

Rising Demand in Automotive Sector

The Global High Performance Epoxy Market Industry experiences a notable surge in demand from the automotive sector. As manufacturers increasingly prioritize lightweight materials to enhance fuel efficiency and reduce emissions, high performance epoxies are becoming essential in vehicle production. These materials offer superior adhesion, chemical resistance, and thermal stability, making them ideal for various automotive applications. In 2024, the market is projected to reach 9.51 USD Billion, reflecting the automotive industry's shift towards advanced composites. This trend is likely to continue, as the sector aims for sustainability and innovation, thereby driving further growth in the Global High Performance Epoxy Market Industry.

Increasing Infrastructure Development

The Global High Performance Epoxy Market Industry benefits from the ongoing infrastructure development across the globe. Governments and private sectors are investing heavily in construction projects, which require durable and reliable materials. High performance epoxies are favored for their excellent bonding capabilities and resistance to environmental factors, making them suitable for applications in bridges, roads, and buildings. As urbanization continues to rise, the demand for high performance materials is expected to increase, further propelling the market. This trend indicates a robust growth trajectory, as infrastructure projects increasingly prioritize the use of advanced materials to ensure longevity and performance.

Technological Advancements in Material Science

Technological advancements in material science play a pivotal role in shaping the Global High Performance Epoxy Market Industry. Innovations in formulation and processing techniques have led to the development of epoxies with enhanced properties, such as improved thermal stability and resistance to harsh environments. These advancements enable the production of high performance epoxies that meet the evolving needs of various industries, including construction, electronics, and marine. As these technologies continue to evolve, they are expected to drive market growth at a CAGR of 6.0% from 2025 to 2035. This trajectory indicates a promising future for high performance epoxies as industries increasingly adopt advanced materials.

Environmental Regulations and Sustainability Initiatives

The Global High Performance Epoxy Market Industry is influenced by stringent environmental regulations and a growing emphasis on sustainability. As industries face pressure to reduce their carbon footprint, high performance epoxies are becoming a preferred choice due to their low volatile organic compound emissions and recyclability. This shift aligns with global sustainability initiatives, prompting manufacturers to adopt eco-friendly materials in their production processes. The increasing awareness of environmental issues is likely to drive demand for high performance epoxies, as companies seek to comply with regulations while enhancing their market competitiveness. This trend suggests a transformative impact on the industry, fostering innovation and responsible practices.

Leave a Comment