Increased Regulatory Standards

The high performance anticorrosion coating market is also being shaped by the implementation of stricter regulatory standards aimed at reducing environmental impact. Governments are increasingly mandating the use of eco-friendly and high-performance coatings in various applications, including industrial and commercial sectors. These regulations are designed to minimize the release of volatile organic compounds (VOCs) and other harmful substances into the environment. As a result, manufacturers are compelled to innovate and develop advanced formulations that comply with these regulations while maintaining high performance characteristics. The market for low-VOC and environmentally friendly coatings is projected to grow significantly, with estimates suggesting a rise of over 6% in the next few years. This shift towards sustainable practices is likely to drive the adoption of high performance anticorrosion coatings, as industries seek to align with regulatory requirements and enhance their sustainability profiles.

Rising Demand from Marine Industry

The marine industry is experiencing a notable increase in demand for high performance anticorrosion coatings. These coatings are essential for protecting vessels and offshore structures from harsh marine environments, which can lead to significant corrosion. The high performance anticorrosion coating market is projected to benefit from this trend, as the need for durable and long-lasting protective solutions becomes more critical. According to recent estimates, the marine sector accounts for a substantial share of the overall coatings market, with a projected growth rate of approximately 5% annually. This growth is driven by the increasing number of shipbuilding projects and the maintenance of existing fleets, which require advanced coatings to ensure longevity and performance. As such, manufacturers are likely to focus on developing innovative formulations tailored to the specific needs of the marine industry.

Growing Awareness of Maintenance Costs

There is a growing awareness among industries regarding the long-term maintenance costs associated with corrosion damage, which is significantly influencing the high performance anticorrosion coating market. Companies are increasingly recognizing that investing in high-quality anticorrosion coatings can lead to substantial savings over time by reducing the frequency and extent of maintenance required. Corrosion-related failures can result in costly repairs and downtime, prompting industries to prioritize protective measures. Recent studies suggest that the cost of corrosion can account for up to 3% of a country's GDP, highlighting the economic impact of corrosion on various sectors. As a result, the demand for high performance anticorrosion coatings is expected to rise, as businesses seek to mitigate these costs and enhance the longevity of their assets. This trend is likely to drive innovation and competition within the coatings market.

Infrastructure Development Initiatives

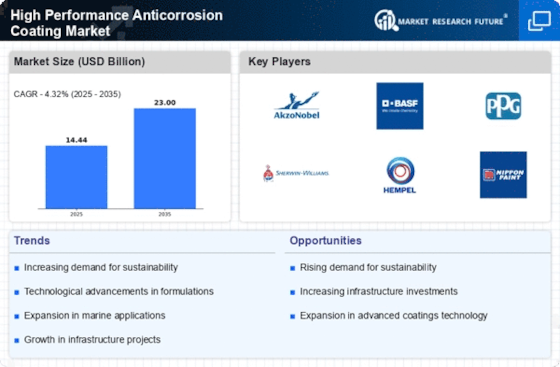

Infrastructure development initiatives across various regions are significantly influencing the high performance anticorrosion coating market. Governments and private sectors are investing heavily in infrastructure projects, including bridges, highways, and buildings, to enhance connectivity and economic growth. This surge in infrastructure projects necessitates the use of high performance anticorrosion coatings to protect structures from environmental degradation and extend their lifespan. Recent data indicates that the construction sector is expected to grow at a compound annual growth rate of around 4% over the next few years, further driving the demand for protective coatings. The emphasis on durability and maintenance in infrastructure projects underscores the importance of high performance anticorrosion coatings, as they provide essential protection against corrosion, thereby reducing long-term maintenance costs and enhancing structural integrity.

Technological Innovations in Coating Solutions

Technological innovations are playing a pivotal role in the evolution of the high performance anticorrosion coating market. Advances in coating technologies, such as nanotechnology and advanced polymer formulations, are enabling the development of coatings with superior protective properties. These innovations enhance the durability, adhesion, and resistance of coatings to various environmental factors, thereby improving their overall performance. The market is witnessing a trend towards smart coatings that can provide real-time monitoring of corrosion levels and environmental conditions. This technological shift is expected to drive growth in the high performance anticorrosion coating market, with projections indicating a potential increase in market size by approximately 7% over the next few years. As industries continue to seek more effective and efficient solutions for corrosion protection, the demand for technologically advanced coatings is likely to rise.