Top Industry Leaders in the High Integrity Pressure Protection System HIPPS Market

The Competitive Landscape of the High Integrity Pressure Protection System HIPPS Market

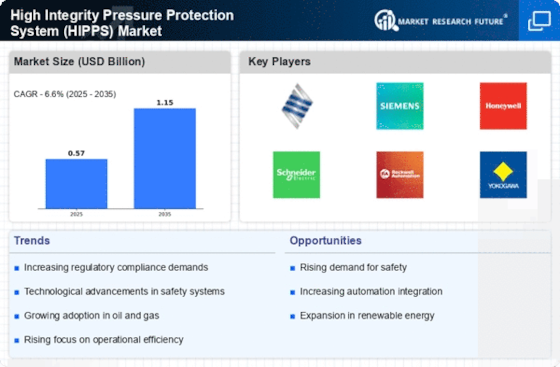

The High Integrity Pressure Protection System (HIPPS) market plays a crucial role in ensuring safety and environmental compliance within the oil & gas, chemical, and power generation industries. As the market navigates a dynamic landscape with evolving regulations and technological advancements, understanding the competitive landscape is critical for both established players and aspiring entrants.

Key Player:

- Rockwell Automation

- Emerson Electric Co.

- Severn Glocon Group

- Schneider Electric

- Yokogawa Electric Corporation

- ABB Ltd

- Siemens AG

- Schlumberger NV

Strategies Adopted by Key Players:

- Technological Innovation: Continuous development of advanced features like self-diagnostics, remote monitoring, and cyber security capabilities enhances system reliability and efficiency.

- Geographic Expansion: Targeting emerging markets with high growth potential in the oil & gas and chemical sectors, particularly in Asia Pacific and the Middle East.

- Strategic Partnerships and Collaborations: Collaborating with technology providers, engineering firms, and system integrators to offer comprehensive solutions and cater to diverse customer needs.

- Focus on Aftermarket Services: Offering maintenance, repair, and overhaul (MRO) services, training programs, and lifecycle management solutions to maximize customer satisfaction and generate recurring revenue streams.

Factors for Market Share Analysis:

- Product Portfolio: Breadth and depth of offerings, including electronic and mechanical HIPPS, customized solutions, and compatibility with various industry standards.

- Technological Expertise: Capabilities in R&D, design, and manufacturing of high-performing and reliable HIPPS systems.

- Geographical Reach: Presence in key markets and ability to cater to regional regulations and requirements.

- Aftermarket Services: Effectiveness and efficiency of maintenance, training, and support programs.

- Brand Reputation and Customer Satisfaction: Trust and confidence established among end-users through consistent quality, performance, and service.

New and Emerging Companies:

- Pro-Tech Valves & Controls: Offers cost-effective HIPPS solutions tailored for specific applications.

- Extech Instruments: Focuses on providing advanced HIPPS controllers with integrated safety features.

- Vega Instruments: Specializes in developing SIL-rated pressure transmitters for HIPPS applications.

- Croswell Technology: Offers innovative HIPPS solutions with wireless communication capabilities.

Latest Company Updates:

Rockwell Automation:

- Date: June 2023

- Update: Rockwell Automation launched its PlantPAx Digital HIPPS, a software-based HIPPS solution that leverages the PlantPAx distributed control system platform. This solution offers simplified engineering, reduced hardware footprint, and improved cybersecurity.

- Date: March 2023

- Update: Rockwell Automation partnered with Yokogawa Electric Corporation to develop and offer integrated safety solutions for the process industry. This includes combining Rockwell Automation's PlantPAx DCS with Yokogawa's Exaquantum safety instrumented system (SIS), which can be used for HIPPS applications.

Emerson Electric Co.:

- Date: May 2023

- Update: Emerson released DeltaV SIS v15, its latest safety instrumented system software. This version includes enhancements for HIPPS applications, such as improved diagnostics and faster response times.

- Date: February 2023

- Update: Emerson announced a strategic partnership with Schneider Electric to collaborate on developing and offering integrated automation and safety solutions for the oil & gas industry. This includes potential collaboration on HIPPS solutions.