Market Share

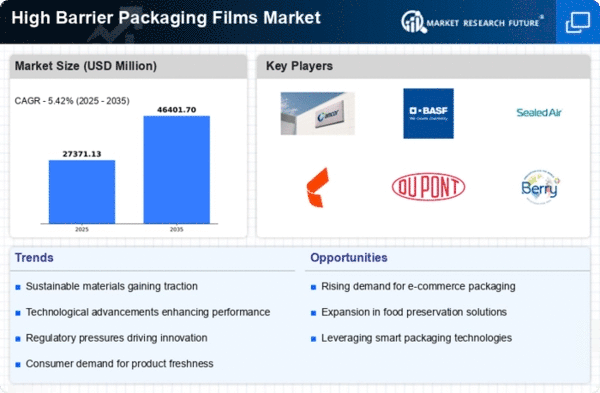

High Barrier Packaging Films Market Share Analysis

The High Barrier Packaging Films Market space has a fast-paced and competitive nature, in which companies try different tactics in order to conquer the market. One of the common ways stimulates this is through selling a product that has a never before been seen innovation. Companies continue use challenging packaging films to ensure that no gas, liquid, or light is penetrating the package and it is being adapted for industries industries i.e. food and pharmaceutical. Through funds invested on research and development, companies may end up with a new technology and materials that differentiate them from the competitors with a good market share and a niche.

In short, a significant marketing strategy is to win the cost leadership game. Others players in key areas of the packaging film market such as economies of scale, optimized processes, and reduced costs, to gain competitiveness, and offer top quality packaging films at affordable cost. This approach enables companies to appeal to a bigger potential customer group, especially the poor consumers in price-sensitive markets. Cost leadership is a sustainable strategy that can be achieved through putting into place operational efficiency; adherence to consumer's demand preference and building viable business model to ensure profitability while at the same time, offering the much-needed cost effective solutions.

Both collaboration and partnerships bag even the strategic way in the release of a strengthened market position within the High Barrier Packaging Films Market. The companies might be teaming up with the suppliers, the distributors, or the competitors to explore the strategies of leverage and grabbing bigger markets. Strategic alliances are very effective in terms of discovering new opportunities and markets, introducing new distribution networks and competent side products to the market, and as a result increasing the overall competitiveness of the market contenders.

Market segmentation is also useful, as it lets enterprises to personalize their businesses for th edifferent industry necessities. Through understanding specific needs of different areas such as food and beverage, health care and electronics companies may develop individualized packaging solutions and invent new eco-friendly methods to use less resources available. This pinpoint technique enables business to deal with the particular difficulties of different beat, grow specific skills domain, enlarge expertise acumen and compete in particular segments. Successful market segmentation leads to the realization of what customers actually need as well as the capability of coping up through the changing market dynamics.

Brand building which means the brand identity constitutes a key component of your market share positioning because your target market trust and is loyal to the brand. Good brand popularity creation include having the same communication, good quality shipped product, and high-quality marketing strategies. Firms resort to brand equity creation to differentiate themselves from the rivals, which gives them a competence their counterparts lack and comes in addition to the functional features their packaging films bring along. There you have it! A brand name that is nicely built can sell products on premium prices and triggers higher profit margins by leading to huge market share.

Leave a Comment