Regulatory Support for Stem Cell Research

Regulatory support for stem cell research is a significant driver of the Hematopoietic Stem Cell Transplantation Market. Governments and regulatory bodies are increasingly recognizing the potential of stem cell therapies, leading to the establishment of favorable policies and funding opportunities. This support facilitates research and development efforts, enabling scientists and clinicians to explore new applications for hematopoietic stem cells. As a result, the market is likely to benefit from an influx of innovative therapies and clinical trials aimed at improving transplant outcomes. The proactive stance of regulatory agencies is expected to foster a conducive environment for growth within the Hematopoietic Stem Cell Transplantation Market, ultimately enhancing patient access to cutting-edge treatments.

Rising Investment in Healthcare Infrastructure

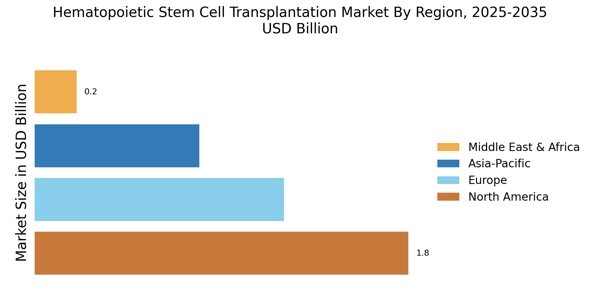

The rising investment in healthcare infrastructure is a crucial factor driving the Hematopoietic Stem Cell Transplantation Market. As countries allocate more resources to enhance their healthcare systems, the availability of advanced medical facilities and technologies increases. This investment enables hospitals and clinics to offer state-of-the-art transplant services, thereby improving patient care and outcomes. Furthermore, the establishment of specialized centers for hematopoietic stem cell transplants is becoming more common, which is likely to attract more patients seeking these treatments. The overall enhancement of healthcare infrastructure is expected to create a favorable environment for the Hematopoietic Stem Cell Transplantation Market, facilitating growth and innovation in the field.

Increasing Incidence of Hematological Disorders

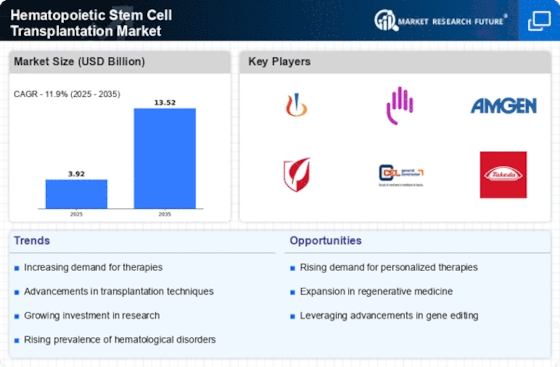

The rising prevalence of hematological disorders, such as leukemia and lymphoma, is a primary driver for the Hematopoietic Stem Cell Transplantation Market. According to recent data, the incidence of these conditions has been steadily increasing, leading to a higher demand for effective treatment options. This trend is further supported by advancements in diagnostic techniques, which allow for earlier detection and intervention. As more patients are diagnosed with these disorders, the need for hematopoietic stem cell transplants becomes more pronounced. The market is projected to grow as healthcare providers seek innovative solutions to address the growing patient population. Consequently, the Hematopoietic Stem Cell Transplantation Market is likely to experience significant expansion in response to these rising incidences.

Technological Innovations in Transplant Procedures

Technological advancements in transplant procedures are significantly influencing the Hematopoietic Stem Cell Transplantation Market. Innovations such as improved cell processing techniques, enhanced imaging technologies, and novel immunosuppressive therapies are enhancing the efficacy and safety of transplants. For instance, the introduction of automated cell processing systems has streamlined the collection and preparation of stem cells, thereby increasing the success rates of transplants. Furthermore, the development of targeted therapies and gene editing technologies holds promise for improving patient outcomes. As these technologies continue to evolve, they are expected to drive growth in the market, as healthcare providers adopt more sophisticated methods to perform hematopoietic stem cell transplants.

Growing Awareness and Acceptance of Stem Cell Therapies

The increasing awareness and acceptance of stem cell therapies among patients and healthcare professionals are pivotal for the Hematopoietic Stem Cell Transplantation Market. Educational initiatives and advocacy efforts have played a crucial role in informing the public about the benefits and potential of stem cell transplants. As patients become more informed, they are more likely to seek out these treatments, leading to a rise in demand. Additionally, healthcare providers are increasingly recognizing the value of stem cell therapies in treating various conditions, further propelling market growth. This shift in perception is likely to enhance the overall landscape of the Hematopoietic Stem Cell Transplantation Market, as more individuals pursue these innovative treatment options.