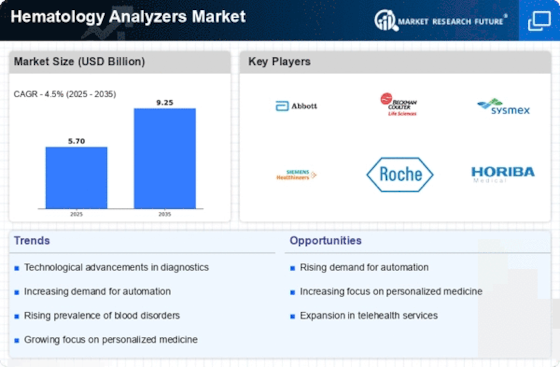

Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare is driving the Hematology Analyzers Market. As healthcare providers shift their focus from reactive to proactive care, the demand for regular blood testing and monitoring has intensified. Hematology analyzers play a vital role in early detection and management of various health conditions, thereby supporting preventive healthcare initiatives. This trend is further fueled by rising health awareness among the population, leading to more individuals seeking routine check-ups and screenings. Consequently, the Hematology Analyzers Market is likely to experience growth as healthcare systems prioritize preventive measures and invest in advanced diagnostic technologies.

Rising Demand for Point-of-Care Testing

The growing preference for point-of-care testing (POCT) is significantly influencing the Hematology Analyzers Market. Healthcare providers are increasingly seeking rapid diagnostic solutions that can be performed at the patient's location, thereby enhancing patient care and reducing wait times. POCT hematology analyzers offer the advantage of immediate results, which is particularly beneficial in emergency situations. This trend is supported by the increasing emphasis on decentralized healthcare and the need for timely decision-making in clinical settings. As a result, the Hematology Analyzers Market is likely to witness a surge in demand for portable and user-friendly analyzers that cater to the needs of point-of-care testing.

Increasing Prevalence of Blood Disorders

The rising incidence of blood disorders, such as anemia, leukemia, and hemophilia, is a primary driver for the Hematology Analyzers Market. As healthcare providers strive to improve patient outcomes, the demand for accurate and efficient diagnostic tools has surged. According to recent data, blood disorders affect millions worldwide, necessitating advanced hematology analyzers for timely diagnosis and treatment. This trend is likely to continue, as the population ages and the prevalence of chronic diseases increases. Consequently, the Hematology Analyzers Market is expected to expand, with manufacturers focusing on developing innovative solutions to meet the growing demand for reliable diagnostic equipment.

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a significant driver for the Hematology Analyzers Market. Governments and private entities are increasingly allocating resources to enhance healthcare facilities, particularly in developing regions. This investment often includes the procurement of advanced diagnostic equipment, including hematology analyzers, to improve healthcare delivery. As healthcare systems expand and modernize, the demand for reliable and efficient hematology analyzers is expected to rise. Furthermore, the establishment of new laboratories and diagnostic centers will likely contribute to the growth of the Hematology Analyzers Market, as these facilities require state-of-the-art equipment to meet the needs of their patient populations.

Technological Innovations in Hematology Analyzers

Technological advancements play a crucial role in shaping the Hematology Analyzers Market. Innovations such as automation, artificial intelligence, and enhanced data analytics are transforming traditional hematology analyzers into sophisticated diagnostic tools. These advancements not only improve the accuracy and speed of blood analysis but also reduce the potential for human error. The integration of AI algorithms allows for more precise interpretation of results, which is essential for effective patient management. As healthcare facilities increasingly adopt these cutting-edge technologies, the Hematology Analyzers Market is poised for significant growth, driven by the demand for more efficient and reliable diagnostic solutions.