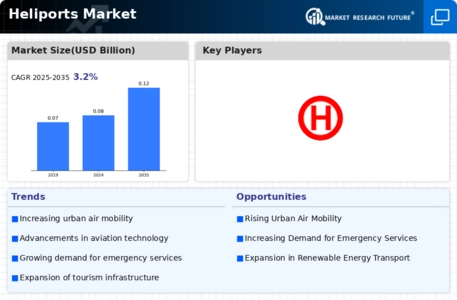

Increased Demand for Air Travel

The Heliports Market is experiencing a notable surge in demand for air travel, particularly in urban areas. This trend is driven by the growing need for efficient transportation solutions that can alleviate traffic congestion. According to recent data, the number of helicopter flights has increased by approximately 15% over the past year, indicating a robust interest in heliport services. As urban populations continue to expand, the necessity for heliports becomes more pronounced, facilitating quick and convenient access to various destinations. This heightened demand is likely to propel investments in heliport infrastructure, thereby enhancing the overall growth of the Heliports Market.

Rise of Tourism and Leisure Travel

The Heliports Market is poised to benefit from the rising trend of tourism and leisure travel. As more travelers seek unique experiences, helicopter tours and charters are becoming increasingly popular. This trend is reflected in the growing number of heliports being established in scenic locations, catering to tourists looking for aerial views and quick access to remote destinations. Recent statistics suggest that helicopter tourism has seen a growth rate of approximately 10% annually, indicating a robust market potential. This burgeoning interest in helicopter travel is likely to stimulate further development within the Heliports Market, as operators expand their services to meet the demands of leisure travelers.

Growth of Emergency Medical Services

The Heliports Market is significantly influenced by the expansion of emergency medical services (EMS). The demand for rapid medical transport has led to an increase in the establishment of heliports near hospitals and emergency response centers. Data indicates that the use of helicopters for medical emergencies has risen by over 20% in recent years, underscoring the critical role of heliports in healthcare. This growth is likely to drive further investments in heliport infrastructure, as healthcare providers seek to enhance their emergency response capabilities. Consequently, the Heliports Market may see a sustained increase in activity and development in response to this growing need.

Regulatory Support for Heliport Development

The Heliports Market benefits from increasing regulatory support aimed at promoting the development of heliports. Governments are recognizing the potential of heliports to improve transportation networks and are implementing policies that streamline the approval process for new heliport projects. For instance, recent legislative changes have reduced the time required for obtaining permits, which could lead to a rise in new heliport constructions. This supportive regulatory environment is expected to encourage private investments, thereby fostering innovation and expansion within the Heliports Market. As a result, the industry may witness a significant increase in the number of operational heliports in the coming years.

Technological Innovations in Helicopter Operations

Technological advancements are playing a crucial role in shaping the Heliports Market. Innovations such as advanced navigation systems, automated landing technologies, and improved safety protocols are enhancing the efficiency and safety of helicopter operations. The integration of these technologies is likely to attract more operators to utilize heliports, as they offer improved operational capabilities. Furthermore, the adoption of electric and hybrid helicopters is anticipated to revolutionize the industry, aligning with sustainability goals. As these technologies continue to evolve, they may significantly impact the operational landscape of the Heliports Market, potentially leading to increased usage and investment.