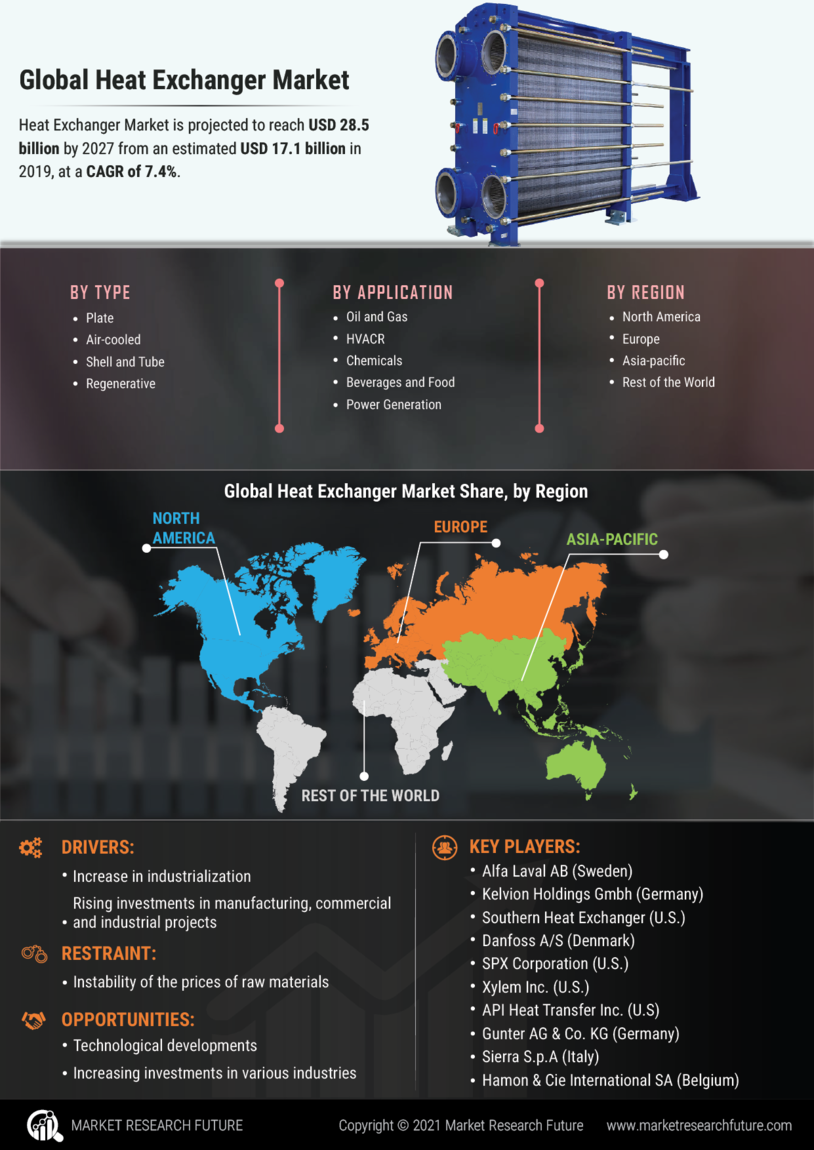

Heat Exchanger Market Summary

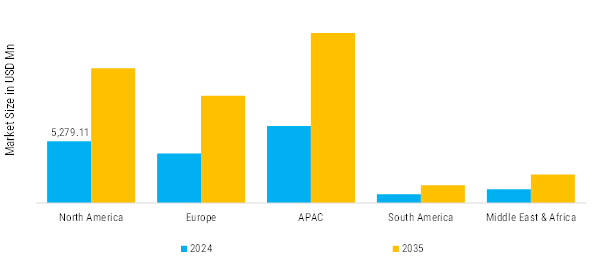

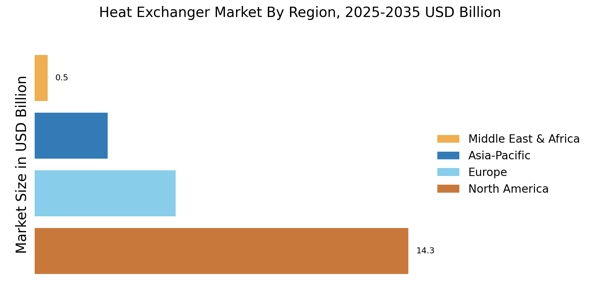

As per Market Research Future analysis, the Heat Exchangers Market Size was estimated at 18029.76 USD Million in 2024. The Heat Exchangers industry is projected to grow from 19445.09 USD Million in 2025 to 39162.99 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.25 % during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Heat Exchangers Market is witnessing steady and robust growth, driven by rising industrialization, energy efficiency requirements, and increasing demand across power generation, HVAC, chemical processing, and automotive sectors.

- Rising demand for energy-efficient thermal management systems across industries such as oil & gas, chemicals, power generation, HVAC, food & beverages, and pharmaceuticals is driving adoption of advanced heat exchanger technologies. Industries are increasingly focusing on reducing energy consumption, improving heat recovery, and lowering operating costs, which is accelerating demand for high-performance and compact heat exchangers.

- Growth in HVAC, refrigeration, and district heating applications, supported by rapid urbanization and infrastructure development, is significantly boosting market expansion. Increasing investments in residential and commercial buildings, along with stricter energy efficiency standards for heating and cooling systems, are encouraging the use of plate, shell & tube, and air-cooled heat exchangers.

- Technological advancements and material innovations—including the use of corrosion-resistant alloys, advanced brazing techniques, additive manufacturing, and compact heat exchanger designs—are enhancing thermal efficiency, durability, and operational reliability. These innovations are enabling heat exchangers to operate under higher pressures and temperatures, expanding their applicability across demanding industrial environments.

- Sustainability and regulatory compliance are shaping market dynamics, as governments and regulatory bodies enforce stringent emission norms, energy efficiency mandates, and carbon reduction targets. This is driving increased adoption of heat exchangers in waste heat recovery systems, renewable energy applications, and low-carbon industrial processes, influencing product innovation, competitive strategies, and long-term growth opportunities for key players in the Heat Exchangers Market.

Market Size & Forecast

| 2024 Market Size | 18029.76 (USD Million) |

| 2035 Market Size | 39162.99 (USD Million) |

| CAGR (2025 - 2035) | 7.25 % |

Major Players

Alfa Laval, Xylem Inc, GEA Group, Hisaka Works Ltd., Danfoss, Kelvion Holding GmBH, Johnson Controls, Exchanger Industries Limited, Mersen, SPX FLOW