Research Methodology on Heart Failure Point of Care and LOC Devices Market

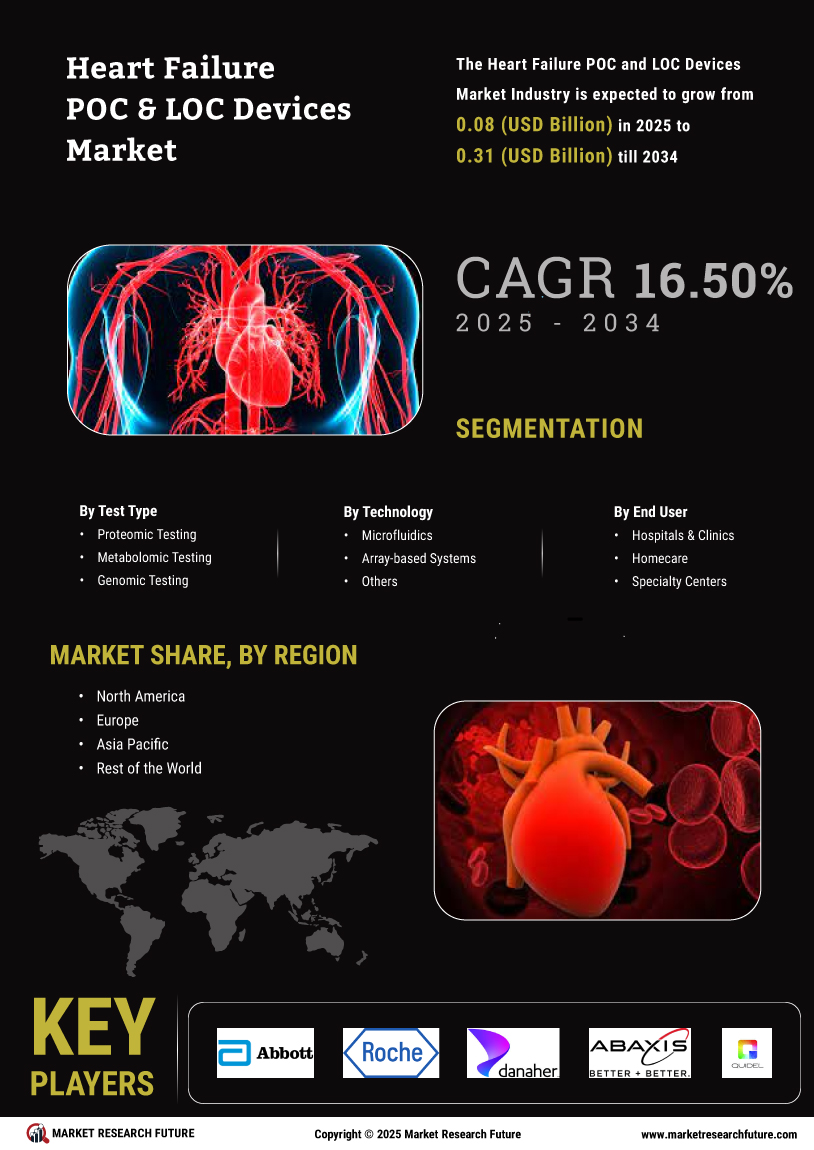

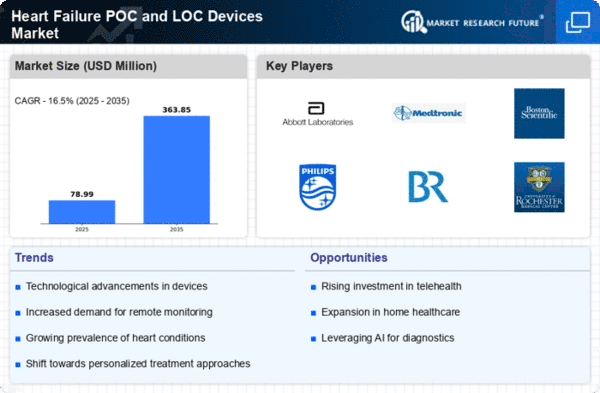

Market Research Future (MRFR) has encapsulated an in-depth assessment of the global Heart Failure Point-Of-Care (POC) and Localized (LOC) Devices Market. The report provides detailed insights into the market share, segmental growth pattern, trends, dynamics, and market driver levers during the forecast period.

The research methodology of this report has been divided into primary and secondary research. Market segmentation is one of the key methodologies used in the market for understanding the true state of the current market.

Primary Research

Primary research is conducted via various surveys and interviews with key industry personnel. This research methodology constitutes a huge chunk of the data collection that allows MRFR to deliver accurate data to its customers. Primary research also aids in validating the secondary data, which we use as reference material for our research analysis. It further helps to differentiate the market forecast and factors of the market. For illustration, we interviewed some of the top players inside and outside the organization in the heart failure POC and LOC devices market space. We also use surveys to understand consumer behaviour and trends, which helped in validating our secondary data.

Secondary Research

Secondary research helps to complement the primary research which is conducted for market intelligence. It was conducted to determine the analysis and hypothesis. Information sourced from various authentic sources such as press releases, blogs, journals, and websites, among others, are collected and analyzed for validating the information collected during the course of primary research. It is also utilized to augment the primary data collected.

Market Segmentation

The global heart failure POC and LOC devices market is segmented on the basis of type, end-user, and therapy type.

By type, the market is segmented into point-of-care devices and localized devices. Point-of-care devices are further segmented into electrocardiography (ECG) devices, blood pressure monitors, and portable electrocardiogram (ECG) devices. Localized devices are further segmented into implantable cardioverter-defibrillators (ICDs), cardiac resynchronization therapy (CRT) devices, and transcatheter heart valve (THV) devices.

By end user, the market for heart failure POC and LOC devices is segmented into hospitals & clinics and ambulatory surgical centres (ASCs).

By therapy type, the market is segmented into medical therapies and surgical therapies. Medical therapies are sub-segmented into oxygen and oxygen therapy, drug treatment, exercise support, mechanical circulatory support, surgery for controlling infection & embolization, optimization of nutrition, cardiac rehabilitation, and cardiac resynchronization therapy (CRT). Surgical therapies are further segmented into percutaneous coronary intervention (PCI), coronary artery bypass grafting (CABG), thoracic aortic aneurysm repair, septal ablation, mitral repair & replacement, valve repair & replacement, and ventricular assist device (VAD) installation.

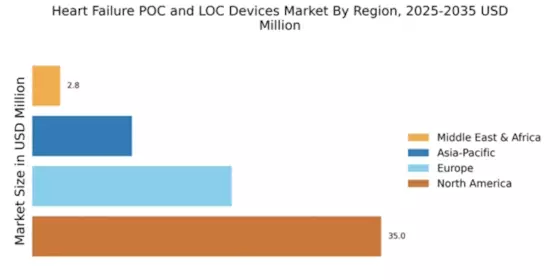

The global heart failure POC and LOC devices market is segmented by region into Asia-Pacific, North America, Europe, and the Rest of the World.

Data Collection-Sources

The sources considered for market intelligence are:

o Databases such as the American College of Surgeons National Surgical Quality Improvement Program (NSQIP) and EuroQol

o Medical journals

o Healthcare magazines

o Internal and external proprietary databases

o Industry reports

o Key opinion leaders

o Doctors

o Surveyors

o Medical fraternity

o Panel of experts

o Medical Research Institutes