Healthcare in Metaverse Market Summary

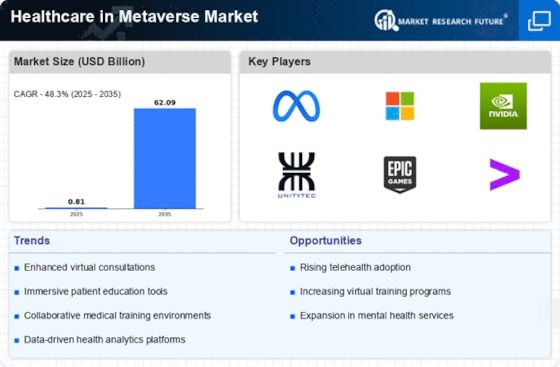

As per Market Research Future analysis, the Healthcare in Metaverse Market was estimated at 0.8137 USD Billion in 2024. The Healthcare in Metaverse industry is projected to grow from 1.207 USD Billion in 2025 to 62.09 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 48.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Healthcare in Metaverse Market is experiencing robust growth driven by technological advancements and evolving patient needs.

- Enhanced patient engagement is becoming a focal point as healthcare providers leverage immersive technologies.

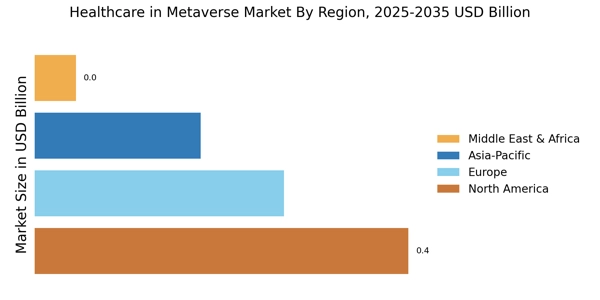

- Innovative medical training solutions are emerging, particularly in North America, to better prepare healthcare professionals.

- Accessible mental health solutions are gaining traction, especially in the Asia-Pacific region, reflecting a growing societal emphasis on wellness.

- The integration of advanced technologies and increased demand for telehealth services are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 0.8137 (USD Billion) |

| 2035 Market Size | 62.09 (USD Billion) |

| CAGR (2025 - 2035) | 48.3% |

Major Players

Meta Platforms (US), Microsoft (US), NVIDIA (US), Unity Technologies (US), Epic Games (US), Accenture (IE), Philips (NL), Siemens Healthineers (DE), Osso VR (US), XRHealth (IL)