North America : Market Leader in Analytics

North America is poised to maintain its leadership in the Healthcare Data Analytics Services Market, holding a significant market share of 25.0 in 2025. The region's growth is driven by increasing healthcare expenditures, technological advancements, and a strong regulatory framework that encourages data-driven decision-making. The demand for analytics services is further fueled by the need for improved patient outcomes and operational efficiencies.

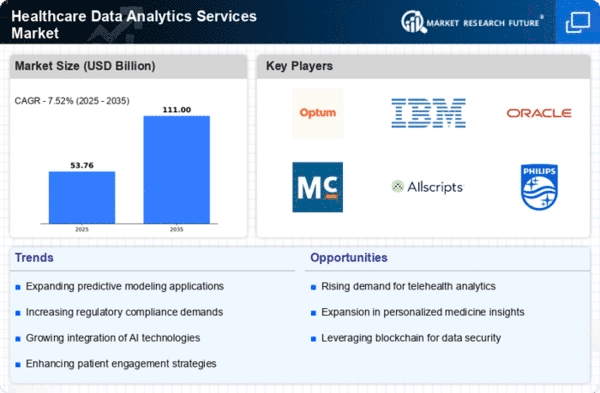

The competitive landscape in North America is robust, featuring key players such as Optum, IBM, and Cerner. These companies leverage advanced technologies like AI and machine learning to enhance their service offerings. The U.S. remains the largest market, supported by a well-established healthcare infrastructure and a high adoption rate of digital health solutions. This environment fosters innovation and attracts investments, solidifying North America's position as a global leader in healthcare analytics.

Europe : Emerging Analytics Hub

Europe is rapidly evolving as a significant player in the Healthcare Data Analytics Services Market, with a market size of 15.0 in 2025. The region benefits from stringent regulations that promote data privacy and security, alongside increasing investments in digital health technologies. The demand for analytics services is driven by the need for enhanced patient care and operational efficiencies, as healthcare providers seek to leverage data for better decision-making.

Leading countries in Europe include Germany, the UK, and France, where major players like Siemens Healthineers and Philips are making substantial contributions. The competitive landscape is characterized by a mix of established firms and innovative startups, all striving to meet the growing demand for data analytics solutions. The European market is expected to witness continued growth as healthcare systems increasingly adopt data-driven approaches to improve service delivery and patient outcomes.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a rapidly growing market for Healthcare Data Analytics Services, with a market size of 8.0 in 2025. The region's growth is fueled by rising healthcare expenditures, increasing adoption of digital health technologies, and government initiatives aimed at enhancing healthcare delivery. Countries like China and India are witnessing significant investments in healthcare infrastructure, which is driving demand for analytics services to improve patient care and operational efficiency.

The competitive landscape in Asia-Pacific is diverse, with both local and international players vying for market share. Key companies such as Cognizant and Epic Systems are expanding their presence in the region, capitalizing on the growing demand for data analytics solutions. As healthcare providers increasingly recognize the value of data-driven insights, the Asia-Pacific market is expected to continue its upward trajectory, supported by favorable regulatory environments and technological advancements.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging as a potential market for Healthcare Data Analytics Services, with a market size of 2.0 in 2025. The growth in this region is driven by increasing healthcare investments, a rising focus on improving healthcare quality, and the adoption of digital health solutions. Governments are increasingly recognizing the importance of data analytics in enhancing healthcare delivery, which is expected to catalyze market growth.

Countries like South Africa and the UAE are leading the way in adopting healthcare analytics, with local and international players entering the market to capitalize on these opportunities. The competitive landscape is still developing, but there is a growing interest from key players to establish a foothold in this region. As healthcare systems evolve, the demand for data analytics services is anticipated to rise, supported by ongoing investments in healthcare infrastructure and technology.