Increasing Investment in R&D

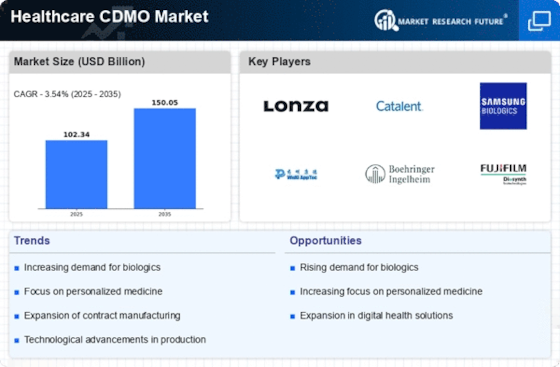

The Healthcare CDMO Market is experiencing a surge in investment directed towards research and development. Pharmaceutical companies are allocating substantial resources to innovate and develop new therapies, particularly in biologics and personalized medicine. This trend is evidenced by the fact that R&D spending in the pharmaceutical sector has reached approximately 200 billion USD annually. Such investments are likely to drive demand for contract development and manufacturing organizations (CDMOs) that can provide specialized services and expertise. As companies seek to streamline their operations and reduce time-to-market, the reliance on CDMOs is expected to grow, thereby enhancing their role within the Healthcare CDMO Market.

Growing Demand for Outsourcing

The trend of outsourcing manufacturing processes is becoming increasingly prevalent within the Healthcare CDMO Market. Pharmaceutical and biotechnology firms are recognizing the advantages of partnering with CDMOs to enhance operational efficiency and focus on core competencies. Recent data indicates that around 60% of pharmaceutical companies are now outsourcing at least a portion of their manufacturing processes. This shift is driven by the need to reduce costs, improve flexibility, and access specialized technologies. Consequently, CDMOs are positioned to capitalize on this trend, as they offer scalable solutions that can adapt to the evolving needs of their clients.

Expansion of Biopharmaceuticals

The biopharmaceutical sector is witnessing rapid growth, which is significantly impacting the Healthcare CDMO Market. With the increasing prevalence of chronic diseases and the aging population, the demand for biopharmaceutical products is expected to rise. Reports suggest that the biopharmaceutical market could reach 500 billion USD by 2025. This expansion is driving pharmaceutical companies to seek CDMOs that specialize in biologics manufacturing, as they require advanced technologies and expertise. Consequently, CDMOs that can offer tailored solutions for biopharmaceutical production are likely to thrive in this evolving landscape.

Technological Innovations in Manufacturing

Technological advancements are reshaping the Healthcare CDMO Market, particularly in manufacturing processes. Innovations such as continuous manufacturing, automation, and digitalization are enhancing efficiency and reducing production costs. The integration of advanced technologies is enabling CDMOs to optimize their operations and improve product quality. For instance, the adoption of artificial intelligence and machine learning in manufacturing processes is streamlining workflows and facilitating data-driven decision-making. As these technologies become more prevalent, CDMOs that leverage them effectively are likely to gain a competitive advantage, thereby influencing the dynamics of the Healthcare CDMO Market.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a critical driver within the Healthcare CDMO Market. As the pharmaceutical landscape becomes increasingly complex, the demand for CDMOs that can navigate stringent regulatory requirements is on the rise. Companies are seeking partners that not only meet compliance standards but also ensure high-quality production processes. The Healthcare CDMO is projected to reach 1.5 trillion USD by 2025, necessitating robust quality assurance measures. CDMOs that can demonstrate their commitment to regulatory adherence and quality control are likely to gain a competitive edge, thereby reinforcing their significance in the Healthcare CDMO Market.