Rising Demand for Enhanced Security

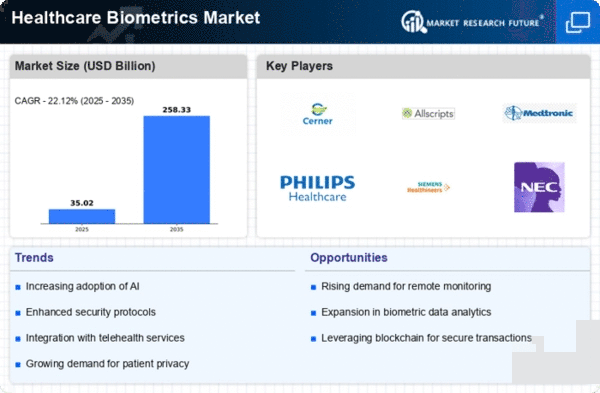

The Global Healthcare Biometrics Market Industry is witnessing a notable surge in demand for enhanced security measures within healthcare facilities. As patient data breaches become increasingly prevalent, healthcare organizations are compelled to adopt biometric solutions to safeguard sensitive information. For instance, biometric authentication systems, such as fingerprint and facial recognition, provide a robust layer of security that traditional methods cannot match. This heightened focus on security is expected to drive the market's growth, with projections indicating a market value of 9.63 USD Billion in 2024. The emphasis on protecting patient privacy and data integrity is likely to propel further investments in biometric technologies.

Growing Awareness of Patient Privacy

Growing awareness of patient privacy is emerging as a vital driver for the Global Healthcare Biometrics Market Industry. As patients become more informed about their rights regarding personal data, healthcare providers are under increasing pressure to implement robust security measures. Biometric technologies offer a compelling solution to address these concerns, as they provide a secure means of verifying patient identities while minimizing the risk of data breaches. This heightened focus on patient privacy is likely to encourage healthcare organizations to invest in biometric systems, further propelling market growth. The convergence of patient expectations and regulatory requirements is expected to shape the future landscape of the industry.

Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the Global Healthcare Biometrics Market Industry. Various governments are implementing policies aimed at enhancing patient safety and data security, which often include mandates for biometric identification systems in healthcare settings. For example, initiatives that promote the adoption of electronic health records (EHR) often require robust authentication methods to protect sensitive patient information. Such regulatory frameworks not only encourage healthcare organizations to invest in biometric technologies but also create a conducive environment for market growth. As a result, the market is expected to experience a compound annual growth rate of 7.06% from 2025 to 2035.

Integration of Biometric Technology in Telehealth

The integration of biometric technology into telehealth services is emerging as a pivotal driver for the Global Healthcare Biometrics Market Industry. As telehealth continues to gain traction, especially in remote patient monitoring and virtual consultations, the need for secure and reliable patient identification becomes paramount. Biometric solutions, such as voice recognition and facial recognition, facilitate seamless and secure interactions between healthcare providers and patients. This trend not only enhances patient experience but also ensures compliance with regulatory standards. The anticipated growth in telehealth services is likely to contribute significantly to the market, with projections suggesting a value of 20.4 USD Billion by 2035.

Technological Advancements in Biometric Solutions

Technological advancements in biometric solutions are significantly influencing the Global Healthcare Biometrics Market Industry. Innovations such as artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric systems, making them more appealing to healthcare providers. For instance, AI-driven facial recognition systems can now identify individuals with remarkable precision, even in challenging conditions. These advancements not only improve security but also streamline patient identification processes, thereby enhancing operational efficiency. As healthcare organizations increasingly recognize the benefits of adopting cutting-edge biometric technologies, the market is poised for substantial growth in the coming years.