North America : Market Leader in MRO

North America continues to lead the Healthcare and Medical Equipment MRO market, holding a significant share of 57.25% in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing demand for medical devices, and stringent regulatory frameworks that ensure quality and safety. The ongoing technological advancements and rising healthcare expenditures further fuel this growth, making it a pivotal market for MRO services.

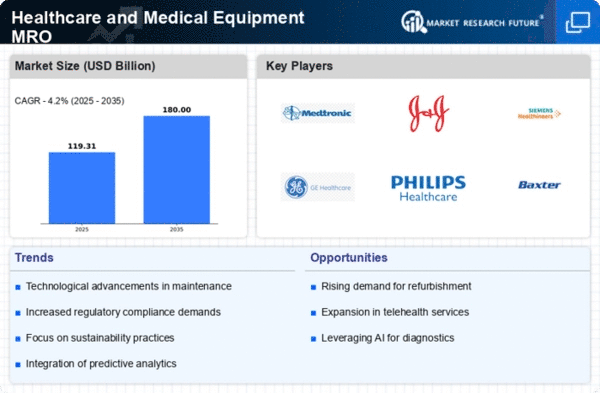

The competitive landscape is characterized by major players such as Medtronic, Johnson & Johnson, and GE Healthcare, which dominate the market with innovative solutions and extensive service networks. The U.S. remains the largest contributor, supported by a robust healthcare system and a high prevalence of chronic diseases. This environment fosters continuous investment in MRO services, ensuring that healthcare facilities maintain optimal operational efficiency.

Europe : Emerging Healthcare Innovations

Europe's Healthcare and Medical Equipment MRO market is poised for growth, accounting for 30.0% of the global share. The region benefits from a strong regulatory environment that promotes innovation and ensures patient safety. Increasing healthcare spending, coupled with an aging population, drives demand for advanced medical equipment and maintenance services. The European market is also witnessing a shift towards sustainable practices, enhancing the appeal of MRO services.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, with key players like Siemens Healthineers and Philips Healthcare driving innovation. The competitive landscape is marked by collaborations and partnerships aimed at enhancing service delivery and technological advancements. As the market evolves, the focus on quality and efficiency in MRO services will be crucial for maintaining competitive advantage.

Asia-Pacific : Rapidly Growing Market Potential

The Asia-Pacific region is emerging as a significant player in the Healthcare and Medical Equipment MRO market, with a share of 20.0%. This growth is fueled by increasing healthcare investments, rising population health awareness, and government initiatives aimed at improving healthcare infrastructure. The demand for medical equipment maintenance is on the rise, driven by the need for quality healthcare services and technological advancements in medical devices.

Countries like China, India, and Japan are leading the charge, with a growing number of healthcare facilities and a surge in chronic diseases necessitating efficient MRO services. The competitive landscape features both local and international players, including Baxter International and Stryker Corporation, who are expanding their presence to meet the growing demand. As the region continues to develop, the focus on quality and compliance will be essential for success in the MRO sector.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region, while smaller in market share at 7.2%, presents unique opportunities for growth in the Healthcare and Medical Equipment MRO sector. The region is experiencing rapid urbanization and healthcare infrastructure development, driven by government initiatives and investments. Increased healthcare spending and a focus on improving patient outcomes are key factors propelling the demand for MRO services in this area.

Countries such as South Africa and the UAE are leading the way, with a growing number of healthcare facilities and a rising demand for advanced medical technologies. The competitive landscape is evolving, with both local and international players seeking to establish a foothold in this emerging market. As the region continues to develop, the emphasis on quality and regulatory compliance will be crucial for MRO service providers.