North America : Market Leader in Consulting Services

North America continues to lead the Health Insurance Consulting Services market, holding a significant share of 18.0 in 2024. The region's growth is driven by increasing healthcare costs, regulatory changes, and a rising demand for personalized health insurance solutions. The Affordable Care Act and other healthcare reforms have catalyzed the need for expert consulting services, enhancing market dynamics and fostering innovation.

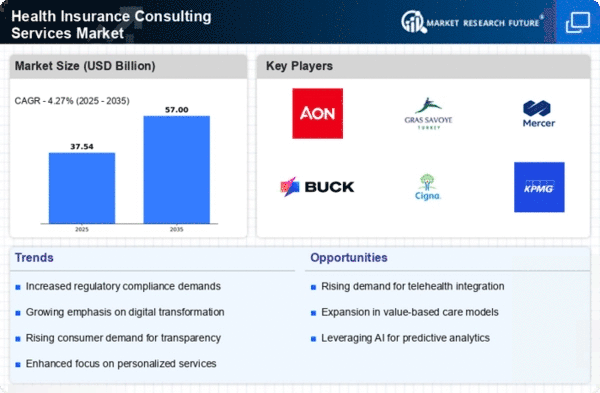

The competitive landscape is robust, with key players like Aon, Mercer, and Deloitte dominating the market. The U.S. is the primary contributor, supported by a strong regulatory framework and a high demand for health insurance consulting. The presence of major firms ensures a diverse range of services, catering to various client needs and driving further market expansion.

Europe : Emerging Market with Growth Potential

Europe's Health Insurance Consulting Services market is valued at 10.5, reflecting a growing demand for tailored health solutions. Factors such as an aging population, rising healthcare expenditures, and regulatory reforms are driving this growth. The European Union's initiatives to enhance healthcare accessibility and affordability are also significant catalysts, encouraging investment in consulting services to navigate complex regulations.

Leading countries like Germany, the UK, and France are at the forefront, with a competitive landscape featuring firms like Willis Towers Watson and PwC. The market is characterized by a mix of established players and emerging consultancies, fostering innovation and diverse service offerings. The region's regulatory environment supports the growth of consulting services, ensuring compliance and quality in health insurance solutions.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region, with a market size of 5.5, is witnessing rapid growth in Health Insurance Consulting Services. Factors such as increasing disposable incomes, urbanization, and a growing awareness of health insurance are driving demand. Governments are also implementing reforms to improve healthcare access, which is further propelling the need for consulting services to guide organizations through these changes.

Countries like China and India are leading the charge, with a burgeoning middle class seeking comprehensive health insurance solutions. The competitive landscape includes both local and international players, such as Accenture and KPMG, who are adapting their services to meet regional needs. This dynamic environment is fostering innovation and enhancing service delivery in the health insurance sector.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region, valued at 2.0, presents unique challenges and opportunities in the Health Insurance Consulting Services market. Rapid population growth, urbanization, and increasing healthcare demands are driving the need for effective consulting services. Governments are investing in healthcare infrastructure, which is creating a favorable environment for consulting firms to thrive and adapt to local needs.

Countries like South Africa and the UAE are leading the market, with a mix of local and international players competing for market share. The presence of firms like Cigna and Buck Global highlights the competitive landscape, where tailored solutions are essential. As the region continues to develop, the demand for expert consulting services is expected to rise, addressing the complexities of health insurance in diverse markets.