North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the harvesting machinery servicing MRO services market, holding a significant market share of 1.75 in 2024. Key growth drivers include advancements in agricultural technology, increasing demand for efficient farming practices, and supportive government regulations promoting sustainable agriculture. The region's robust infrastructure and investment in R&D further enhance its market position.

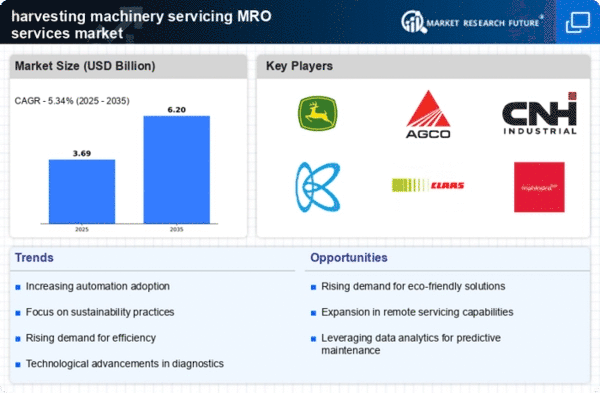

The competitive landscape is characterized by major players such as John Deere, AGCO Corporation, and CNH Industrial, which dominate the market with innovative solutions and extensive service networks. The U.S. and Canada are the leading countries, benefiting from a strong agricultural sector and high adoption rates of advanced machinery. This competitive environment fosters continuous improvement and service excellence among key players, ensuring a dynamic market.

Europe : Emerging Market with Growth Potential

Europe's harvesting machinery servicing MRO services market is valued at 1.0, reflecting a growing demand driven by the need for modernization in agriculture and compliance with environmental regulations. The European Union's policies promoting sustainable farming practices and technological innovation are key catalysts for market growth. Additionally, the increasing focus on food security and efficiency in agricultural operations further fuels demand for MRO services.

Leading countries in this region include Germany, France, and the UK, where major players like Claas KGaA mbH and SDF Group are actively enhancing their service offerings. The competitive landscape is marked by a mix of established companies and emerging players, all striving to meet the evolving needs of farmers. This dynamic environment is supported by a strong regulatory framework that encourages investment in advanced harvesting technologies.

Asia-Pacific : Rapidly Growing Agricultural Sector

The Asia-Pacific region, with a market size of 0.6, is rapidly emerging as a significant player in the harvesting machinery servicing MRO services market. Key growth drivers include increasing agricultural productivity, rising population demands, and government initiatives aimed at modernizing farming practices. Countries like India and China are investing heavily in agricultural technology, which is expected to boost the demand for MRO services in the coming years.

The competitive landscape features key players such as Mahindra & Mahindra and Kubota Corporation, who are expanding their service networks to cater to the growing market. The presence of diverse agricultural practices across the region creates opportunities for tailored MRO solutions. As the sector evolves, the focus on efficiency and sustainability will drive further growth in this dynamic market.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region, with a market size of 0.15, presents significant growth opportunities in the harvesting machinery servicing MRO services market. Factors such as increasing agricultural investments, government initiatives to enhance food security, and a growing focus on mechanization are driving demand. The region's diverse agricultural landscape offers unique challenges and opportunities for MRO service providers, making it a potential growth hub.

Leading countries include South Africa and Kenya, where local players are beginning to establish their presence in the MRO services market. The competitive landscape is evolving, with both local and international companies vying for market share. As the region continues to develop its agricultural capabilities, the demand for efficient and reliable MRO services is expected to rise, paving the way for future growth.