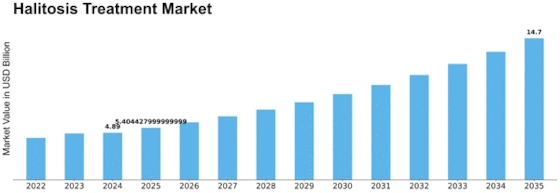

Halitosis Treatment Size

Halitosis Treatment Market Growth Projections and Opportunities

Halitosis, commonly known as chronic bad breath, is a condition where an unpleasant odor is present in a person's breath and can be noticed by others. This issue can arise from various dental problems, including gum diseases, infections in the mouth or throat (such as sinusitis), dry mouth, smoking, and chronic health conditions like diabetes, liver disorders, or kidney disease. According to the American Dental Association (ADA) and the Mayo Clinic, postnasal drip caused by nose, sinus, and throat problems can also contribute to bad breath. Dry mouth, often linked to alcohol and tobacco use or excessive caffeine consumption, is another culprit. The Centers for Disease Control and Prevention (CDC) consider halitosis as a significant warning sign for periodontal diseases.

The impact of bad breath extends beyond personal discomfort, affecting social interactions and potentially leading to stress and psychological pressure. To address this issue, a variety of oral care products are available in the market. Mouthwashes, mint sprays, toothpaste, and other dental care items are commonly used to combat bad breath. Maintaining good oral hygiene is crucial in preventing dental problems, and major players in the market focus on manufacturing oral care products in different flavors to attract customers while ensuring product quality.

The market for halitosis treatment is witnessing substantial growth, driven by factors such as the increasing prevalence of halitosis and periodontal diseases. The Journal of Natural Science, Biology, and Medicine reports that halitosis is prevalent in more than 50% of the general population. Technological advancements in dentistry, such as the use of breathalyzers to detect levels of bacteria causing bad breath, have further fueled the expansion of the global halitosis market.

In terms of market segmentation, halitosis treatment is categorized based on the type of halitosis, including pathological halitosis and other types like physiological halitosis and halitophobia. Pathological halitosis held the largest market share in 2016, primarily due to the increasing incidence of allergic conditions worldwide. Within pathological halitosis, intraoral pathogenic halitosis represents the largest segment and is expected to grow at a compound annual growth rate (CAGR) of 18.90% during the forecast period from 2017-2023. This indicates a rising demand for treatments targeting specific types of halitosis.

In conclusion, halitosis is a prevalent issue with global implications, affecting individuals both socially and psychologically. The market for halitosis treatment is expanding, driven by the growing prevalence of the condition and advancements in dental technology. Understanding the various causes and types of halitosis is crucial for developing effective treatments and maintaining good oral hygiene to prevent such issues.

Leave a Comment