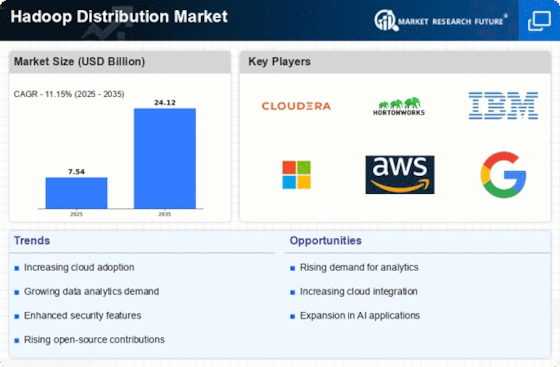

North America : Leading Innovation Hub

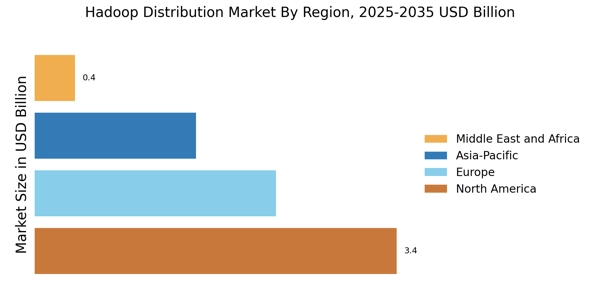

North America is the largest market for Hadoop distribution, holding approximately 45% of the global share. The region's growth is driven by the increasing adoption of big data analytics across various sectors, including finance, healthcare, and retail. Regulatory support for data privacy and security, such as the CCPA, further catalyzes market expansion. The demand for scalable data solutions is also on the rise, pushing organizations to adopt Hadoop for its flexibility and cost-effectiveness.

The competitive landscape in North America is robust, with key players like Cloudera, IBM, and Microsoft leading the charge. The presence of major tech hubs in cities like San Francisco and New York fosters innovation and collaboration among startups and established firms. Additionally, the region benefits from a skilled workforce and significant investment in research and development, ensuring its continued leadership in the Hadoop distribution market.

Europe : Emerging Data Powerhouse

Europe is witnessing a significant rise in Hadoop distribution adoption, accounting for approximately 30% of the global market share. The region's growth is fueled by increasing data generation and the need for advanced analytics solutions across industries such as telecommunications and manufacturing. Regulatory frameworks like the GDPR are also shaping the market, encouraging organizations to adopt compliant data management solutions that Hadoop can provide.

Leading countries in Europe include Germany, the UK, and France, which are at the forefront of Hadoop implementation. The competitive landscape features both established players and emerging startups, with companies like IBM and Oracle playing pivotal roles. The European market is characterized by a strong emphasis on data privacy and security, driving demand for Hadoop solutions that align with regulatory requirements.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is rapidly emerging as a key player in the Hadoop distribution market, holding around 20% of the global share. The region's growth is propelled by the increasing digital transformation initiatives across various sectors, including e-commerce, finance, and telecommunications. Government initiatives promoting smart cities and digital economies are also acting as catalysts for Hadoop adoption, enabling organizations to leverage big data for enhanced decision-making.

Countries like China, India, and Japan are leading the charge in Hadoop implementation, with a growing number of tech startups and established firms investing in big data solutions. The competitive landscape is diverse, featuring both local and international players. Companies such as Amazon Web Services and Google are expanding their presence, contributing to the region's dynamic market environment.

Middle East and Africa : Emerging Data Frontier

The Middle East and Africa region is gradually emerging in the Hadoop distribution market, currently holding about 5% of the global share. The growth is driven by increasing investments in IT infrastructure and the rising demand for data analytics solutions across sectors like oil and gas, finance, and telecommunications. Government initiatives aimed at digital transformation are also fostering a conducive environment for Hadoop adoption, as organizations seek to harness big data for operational efficiency.

Leading countries in this region include South Africa, the UAE, and Nigeria, which are making strides in implementing Hadoop solutions. The competitive landscape is evolving, with both local and international players vying for market share. Companies like Microsoft and Oracle are establishing partnerships to enhance their offerings, contributing to the region's growth potential in the Hadoop distribution market.