Supportive Regulatory Frameworks

The establishment of supportive regulatory frameworks is a vital driver for the Ground-Mount PV Utility Market. Governments worldwide are implementing policies that promote the adoption of solar energy, including tax incentives, feed-in tariffs, and renewable energy mandates. These regulations create a conducive environment for investment in ground-mounted solar projects. For instance, many regions have set ambitious renewable energy targets, which necessitate the expansion of solar capacity. Data shows that countries with robust regulatory support have seen a marked increase in solar installations, with ground-mounted systems often being favored for their scalability. This regulatory backing not only reduces financial risks for investors but also encourages technological innovation within the Ground-Mount PV Utility Market. As these frameworks evolve, they are likely to further stimulate market growth and attract new players into the sector.

Rising Demand for Renewable Energy

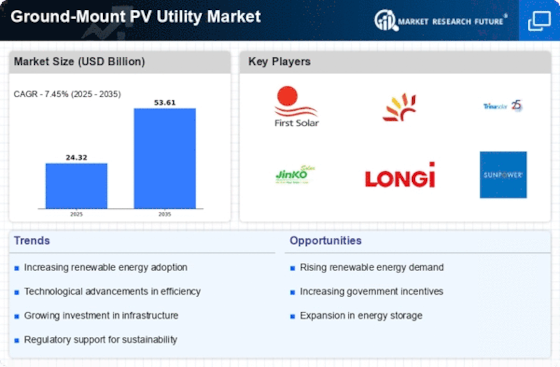

The increasing global emphasis on renewable energy sources is a primary driver for the Ground-Mount PV Utility Market. As nations strive to meet ambitious climate goals, the demand for solar energy continues to rise. According to recent data, solar energy capacity has expanded significantly, with ground-mounted systems accounting for a substantial portion of this growth. This trend is likely to persist as governments and corporations alike seek sustainable energy solutions. The Ground-Mount PV Utility Market is positioned to benefit from this shift, as these systems offer efficient land use and scalability. Furthermore, the integration of solar energy into national grids is becoming more prevalent, enhancing the attractiveness of ground-mounted solar installations. This growing demand for renewable energy not only supports environmental objectives but also stimulates economic growth, creating a favorable environment for investment in the Ground-Mount PV Utility Market.

Increasing Energy Security Concerns

Concerns regarding energy security are becoming increasingly prominent, driving interest in the Ground-Mount PV Utility Market. As geopolitical tensions and supply chain vulnerabilities emerge, nations are seeking to diversify their energy sources to reduce dependence on fossil fuels. Ground-mounted solar installations provide a reliable and sustainable energy solution that can enhance energy independence. Data suggests that countries investing in renewable energy infrastructure, including ground-mounted solar, are better positioned to withstand energy supply disruptions. This shift towards energy security is likely to accelerate the adoption of solar technologies, as governments and businesses recognize the strategic importance of renewable energy. The Ground-Mount PV Utility Market stands to gain from this trend, as more stakeholders prioritize investments in resilient energy systems that can withstand external shocks and contribute to long-term sustainability.

Economic Viability and Cost Competitiveness

The economic viability of ground-mounted solar systems is a significant driver for the Ground-Mount PV Utility Market. As the cost of solar technology continues to decline, ground-mounted installations are becoming increasingly attractive to investors and developers. Recent data indicates that the levelized cost of electricity (LCOE) from solar has reached competitive levels compared to conventional energy sources. This cost competitiveness is bolstered by economies of scale associated with larger ground-mounted projects, which can lead to lower installation and operational costs. Furthermore, the financial landscape for renewable energy is evolving, with more financing options available for solar projects. This trend enhances the attractiveness of ground-mounted solar investments, as stakeholders recognize the potential for favorable returns. As economic conditions continue to favor renewable energy, the Ground-Mount PV Utility Market is likely to experience sustained growth and increased participation from various market players.

Technological Innovations in Solar Technology

Technological advancements play a crucial role in shaping the Ground-Mount PV Utility Market. Innovations in photovoltaic technology, such as bifacial solar panels and improved inverter systems, enhance the efficiency and output of ground-mounted solar installations. These advancements have led to a decrease in the cost per watt of solar energy, making it more competitive with traditional energy sources. Data indicates that the efficiency of solar panels has improved significantly over the past decade, with some models achieving efficiencies above 22%. This trend is expected to continue, further driving the adoption of ground-mounted systems. Additionally, advancements in energy storage solutions complement these technologies, allowing for better energy management and reliability. As these innovations proliferate, they are likely to attract more investments into the Ground-Mount PV Utility Market, fostering a cycle of growth and technological enhancement.