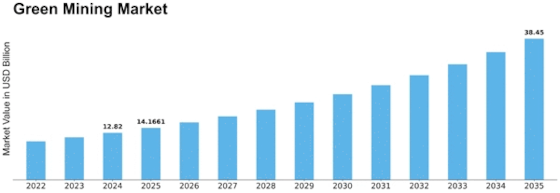

Green Mining Size

Green Mining Market Growth Projections and Opportunities

Green Mining Market Size was valued at USD 10.5 Billion in 2022. The Green Mining industry is projected to grow from USD 11.6 Billion in 2023 to USD 25.8 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.50%

Environmental Regulations and Compliance: Stringent environmental regulations imposed by governments and international bodies drive the adoption of green mining practices. Compliance with these regulations is essential for mining companies to operate legally and sustainably, influencing market dynamics.

Technological Innovations: Advancements in technology, such as automated machinery, renewable energy sources, and advanced monitoring systems, are transforming the mining industry towards greener practices. Integration of these technologies enhances efficiency, reduces environmental impact, and fosters market growth.

Resource Scarcity and Demand: Depletion of traditional resources and increasing demand for minerals necessitate the adoption of sustainable mining practices. Green mining offers solutions to address resource scarcity concerns while meeting the growing demand for essential minerals, influencing market dynamics.

Cost Savings and Efficiency: Green mining practices, including energy efficiency measures and waste reduction initiatives, not only minimize environmental impact but also result in cost savings for mining companies. The potential for reduced operational costs drives the adoption of green mining practices and influences market trends.

Investor Preferences and ESG Criteria: Investors increasingly prioritize environmental, social, and governance (ESG) criteria when making investment decisions. Mining companies that embrace green practices and demonstrate commitment to sustainability attract investment, influencing market dynamics and shaping industry standards.

Community Engagement and Social Responsibility: Engagement with local communities and adherence to social responsibility principles are integral aspects of green mining initiatives. Mining companies that prioritize community well-being and environmental stewardship foster positive relationships, influencing market perception and competitiveness.

Supply Chain Sustainability: Green mining extends beyond on-site operations to include sustainable practices throughout the entire supply chain. Collaboration with suppliers and partners to adopt environmentally friendly practices enhances market sustainability and resilience.

Market Demand for Sustainable Products: Consumer demand for ethically sourced and environmentally sustainable products influences the mining industry. Green mining practices contribute to the production of sustainable raw materials, aligning with consumer preferences and driving market demand.

Government Incentives and Support: Governments and regulatory bodies incentivize green mining initiatives through grants, subsidies, and tax incentives. Policy support for sustainable mining practices encourages industry-wide adoption and influences market dynamics.

Risk Mitigation and Long-Term Viability: Green mining practices mitigate environmental risks and enhance the long-term viability of mining operations. Mining companies that prioritize sustainability are better positioned to withstand regulatory changes, market fluctuations, and environmental challenges, influencing market resilience.

Leave a Comment