North America : Market Leader in MRO Services

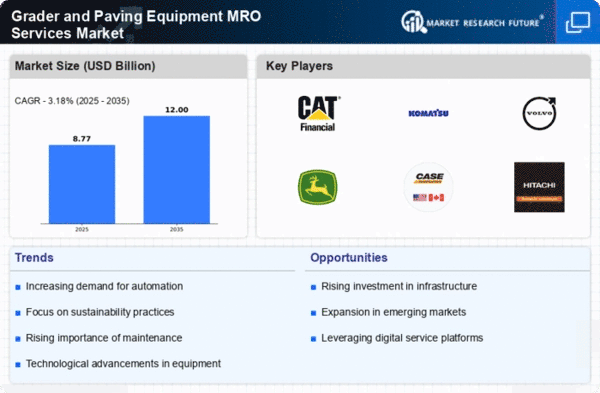

North America is poised to maintain its leadership in the Grader and Paving Equipment MRO Services Market, holding a significant market share of 4.25 in 2024. The region's growth is driven by robust infrastructure investments, technological advancements, and a strong focus on maintenance and repair services. Regulatory support for sustainable construction practices further fuels demand, ensuring a steady market trajectory.

The competitive landscape in North America is characterized by the presence of major players such as Caterpillar, John Deere, and CASE Construction. These companies leverage advanced technologies and extensive service networks to meet the growing demand for MRO services. The U.S. remains the largest market, supported by ongoing public and private sector projects aimed at enhancing infrastructure resilience and efficiency.

Europe : Emerging Market with Potential

Europe's Grader and Paving Equipment MRO Services Market is projected to grow, with a market size of 2.5 in 2024. Key growth drivers include increasing urbanization, stringent environmental regulations, and a shift towards sustainable construction practices. The European Union's commitment to infrastructure development and green initiatives is expected to catalyze demand for MRO services, enhancing market dynamics.

Leading countries in this region include Germany, France, and the UK, where major players like Volvo and Liebherr are actively expanding their service offerings. The competitive landscape is evolving, with companies focusing on innovation and customer-centric solutions to capture market share. The presence of established firms and new entrants is fostering a dynamic environment for MRO services in Europe.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing rapid growth in the Grader and Paving Equipment MRO Services Market, with a market size of 1.75 in 2024. This growth is fueled by increasing infrastructure development, urbanization, and government initiatives aimed at enhancing transportation networks. The region's focus on modernization and efficiency in construction practices is driving demand for MRO services, creating a favorable market environment.

Countries like China, Japan, and India are leading the charge, with significant investments in infrastructure projects. Key players such as Komatsu and Hitachi Construction Machinery are well-positioned to capitalize on this growth. The competitive landscape is marked by a mix of established companies and local players, all vying for a share of the expanding market for MRO services in Asia-Pacific.

Middle East and Africa : Emerging Opportunities Ahead

The Middle East and Africa region is gradually emerging in the Grader and Paving Equipment MRO Services Market, with a market size of 0.5 in 2024. The growth is driven by increasing investments in infrastructure, urban development, and a rising demand for efficient construction practices. Government initiatives aimed at enhancing transportation and logistics networks are expected to further stimulate market growth in this region.

Leading countries such as the UAE and South Africa are at the forefront of this development, with key players like Terex Corporation and JCB actively participating in the market. The competitive landscape is evolving, with both international and local companies striving to meet the growing demand for MRO services. As infrastructure projects continue to expand, the region presents significant opportunities for growth in the MRO sector.