Regulatory Compliance and Standards

The GPS GNSS Receivers Aviation Market is increasingly influenced by stringent regulatory frameworks and compliance standards. Aviation authorities worldwide, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), have established guidelines that mandate the use of advanced navigation systems. These regulations aim to enhance safety and operational efficiency in aviation. As a result, manufacturers are compelled to innovate and upgrade their GPS GNSS receivers to meet these evolving standards. The market is projected to grow as airlines and operators invest in compliant technologies, with an estimated increase in demand for certified systems by 15% over the next five years. This regulatory push not only drives technological advancements but also fosters a competitive landscape among industry players.

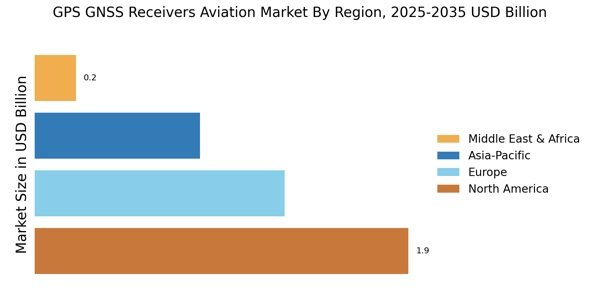

Emerging Markets and Regional Growth

The GPS GNSS Receivers Aviation Market is poised for expansion in emerging markets, where aviation infrastructure is rapidly developing. Countries in Asia-Pacific, Latin America, and parts of Africa are investing heavily in their aviation sectors, leading to increased demand for advanced navigation systems. As these regions enhance their air traffic management systems, the need for reliable GPS GNSS receivers becomes paramount. Market growth in these areas is expected to outpace that of more established markets, with a projected CAGR of 14% over the next five years. This trend presents significant opportunities for manufacturers and suppliers to penetrate new markets and establish a foothold in regions with burgeoning aviation industries.

Integration of Advanced Technologies

The GPS GNSS Receivers Aviation Market is significantly impacted by the integration of advanced technologies such as artificial intelligence (AI) and machine learning. These technologies enhance the functionality of GPS GNSS receivers, enabling real-time data processing and improved decision-making capabilities. The incorporation of AI allows for predictive analytics, which can optimize flight paths and reduce fuel consumption. As airlines and operators increasingly adopt these technologies, the demand for sophisticated GPS GNSS receivers is expected to rise. Market analysts project that the integration of AI and machine learning could lead to a 20% increase in the efficiency of navigation systems, thereby driving growth in the GPS GNSS receivers market.

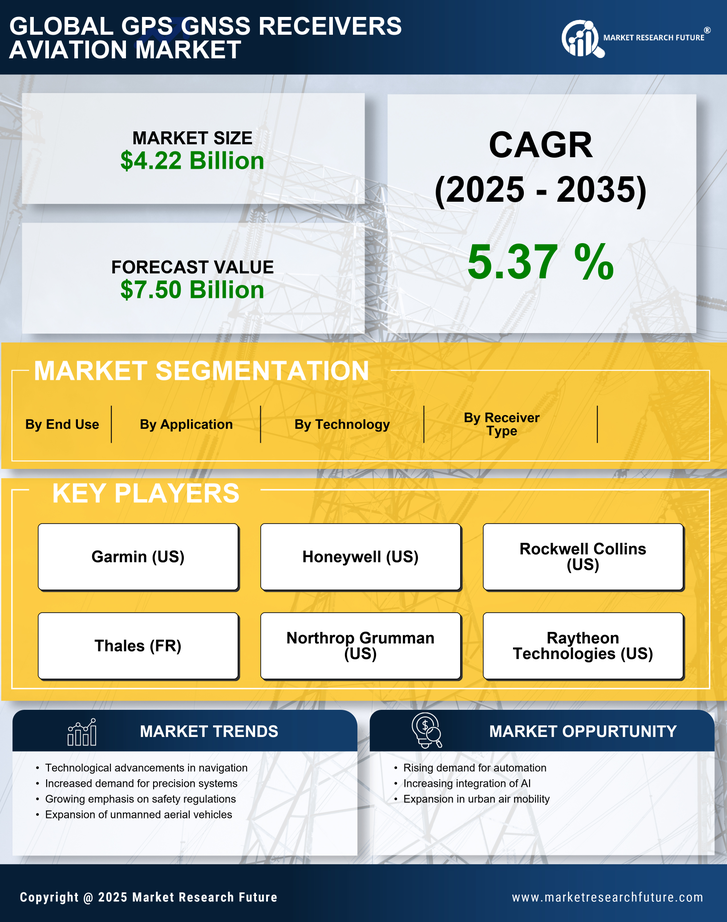

Growing Air Traffic and Fleet Expansion

The GPS GNSS Receivers Aviation Market is experiencing a surge in demand driven by the increasing volume of air traffic and the expansion of aircraft fleets. According to aviation forecasts, air traffic is expected to double in the next two decades, necessitating more efficient navigation solutions. Airlines are investing in new aircraft equipped with advanced GPS GNSS receivers to enhance operational efficiency and safety. This trend is further supported by the rise of low-cost carriers, which are expanding their fleets to capture a larger market share. The market for GPS GNSS receivers is anticipated to grow at a compound annual growth rate (CAGR) of approximately 10% as operators seek to modernize their fleets and improve navigation capabilities.

Increased Focus on Environmental Sustainability

The GPS GNSS Receivers Aviation Market is witnessing a shift towards environmental sustainability, prompting airlines to adopt greener technologies. As global awareness of climate change intensifies, aviation stakeholders are under pressure to reduce their carbon footprint. GPS GNSS receivers play a crucial role in optimizing flight operations, which can lead to lower emissions. Airlines are increasingly investing in these systems to enhance fuel efficiency and minimize environmental impact. The market is likely to see a rise in demand for eco-friendly navigation solutions, with projections indicating a potential growth of 12% in the adoption of sustainable technologies over the next five years. This focus on sustainability not only aligns with regulatory requirements but also meets consumer expectations for environmentally responsible practices.