Market Growth Projections

The Global Glycolic Acid Market Industry is poised for substantial growth, with projections indicating a market value of 0.63 USD Billion in 2024 and an anticipated increase to 3.11 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 15.64% from 2025 to 2035, reflecting the increasing adoption of glycolic acid in various sectors, including cosmetics, pharmaceuticals, and personal care. The market's expansion is likely to be driven by rising consumer awareness, technological advancements, and the growing demand for effective skincare solutions.

Rising Demand for Skincare Products

The Global Glycolic Acid Market Industry experiences a notable surge in demand for skincare products, driven by increasing consumer awareness regarding skin health and appearance. Glycolic acid, known for its exfoliating properties, is widely utilized in various formulations, including cleansers, serums, and peels. This trend is particularly pronounced among millennials and Gen Z consumers, who prioritize skincare routines. As of 2024, the market is valued at approximately 0.63 USD Billion, with projections indicating a growth trajectory that could reach 3.11 USD Billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 15.64% from 2025 to 2035, underscoring the expanding role of glycolic acid in the beauty industry.

Emerging Markets and Consumer Trends

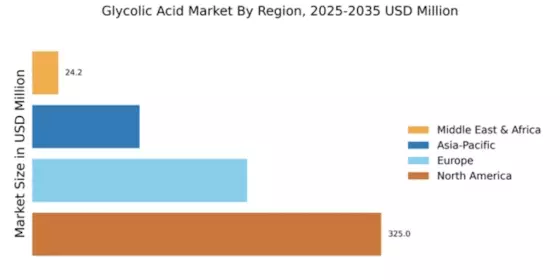

Emerging markets present a significant opportunity for the Global Glycolic Acid Market Industry, as rising disposable incomes and changing consumer preferences drive demand for skincare products. In regions such as Asia-Pacific and Latin America, consumers are increasingly investing in personal care and beauty products, including those containing glycolic acid. This trend is fueled by a growing middle class and heightened awareness of skincare benefits. As these markets continue to develop, the demand for glycolic acid is expected to rise, contributing to the overall market growth and diversification of product offerings.

Growing Interest in Anti-Aging Solutions

The Global Glycolic Acid Market Industry is significantly impacted by the growing interest in anti-aging solutions among consumers. Glycolic acid is recognized for its ability to reduce fine lines, wrinkles, and uneven skin tone, making it a sought-after ingredient in anti-aging products. With an aging global population, particularly in developed regions, the demand for effective anti-aging treatments continues to rise. This trend is expected to contribute to the market's expansion, as consumers increasingly seek products that deliver visible results. The emphasis on maintaining youthful skin is likely to drive innovation and investment in glycolic acid formulations.

Technological Advancements in Formulations

Technological advancements in the formulation of glycolic acid products significantly influence the Global Glycolic Acid Market Industry. Innovations in delivery systems and product stability enhance the efficacy and safety of glycolic acid in various applications. For instance, the development of encapsulation techniques allows for controlled release, minimizing irritation while maximizing benefits. Such advancements not only improve consumer satisfaction but also expand the potential applications of glycolic acid beyond traditional skincare, including hair care and body treatments. As the industry evolves, these technological improvements are likely to attract a broader consumer base, further propelling market growth.

Regulatory Support for Cosmetic Ingredients

Regulatory support for cosmetic ingredients, including glycolic acid, plays a crucial role in shaping the Global Glycolic Acid Market Industry. Governments and regulatory bodies are increasingly recognizing the safety and efficacy of glycolic acid, leading to favorable regulations that facilitate its use in cosmetic formulations. This support not only encourages manufacturers to innovate but also instills consumer confidence in the products they purchase. As regulations evolve to accommodate new scientific findings, the market is likely to benefit from increased acceptance and utilization of glycolic acid in a variety of applications, further driving growth.