Enhanced Operational Efficiency

Operational efficiency remains a critical driver in the Telematics for Fishing Boats Market. Fishing operators are increasingly adopting telematics solutions to optimize their routes, reduce fuel consumption, and improve catch rates. By utilizing data analytics and GPS tracking, these systems enable fishermen to make informed decisions, thereby enhancing productivity. Reports indicate that fishing vessels equipped with telematics can achieve up to a 15% reduction in operational costs. This efficiency not only boosts profitability but also contributes to sustainable fishing practices, aligning with the industry's growing emphasis on resource management.

Expansion of Connectivity Solutions

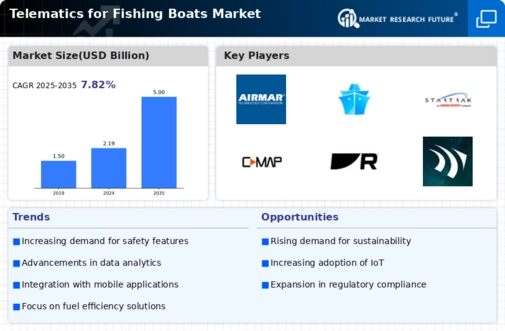

The expansion of connectivity solutions is a pivotal driver in the Telematics for Fishing Boats Market. With the proliferation of satellite and cellular networks, fishing vessels can now access real-time data and communication tools, enhancing their operational capabilities. This connectivity allows for better fleet management and coordination among fishing operators. As connectivity solutions become more robust and accessible, the adoption of telematics systems is expected to rise, with projections indicating a market growth rate of 15% over the next five years. This trend underscores the importance of reliable communication in modern fishing operations.

Integration of Advanced Technologies

The integration of advanced technologies is reshaping the Telematics for Fishing Boats Market. Innovations such as artificial intelligence, machine learning, and big data analytics are being incorporated into telematics systems, providing deeper insights into fishing patterns and environmental conditions. These technologies facilitate predictive maintenance, allowing operators to anticipate equipment failures and reduce downtime. As the industry embraces these advancements, the market for telematics solutions is expected to expand significantly, with estimates suggesting a potential increase in market size by 20% over the next few years.

Rising Demand for Safety and Compliance

The Telematics for Fishing Boats Market is experiencing a notable increase in demand for safety and compliance solutions. Regulatory bodies are imposing stricter safety standards for fishing vessels, necessitating the integration of telematics systems. These systems provide real-time monitoring of vessel conditions, ensuring adherence to safety protocols. As a result, fishing operators are investing in telematics solutions to avoid penalties and enhance operational safety. The market for telematics in this sector is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by the need for compliance and safety enhancements.

Growing Awareness of Environmental Impact

There is a growing awareness of the environmental impact of fishing practices, which is influencing the Telematics for Fishing Boats Market. Stakeholders are increasingly recognizing the importance of sustainable fishing methods, prompting the adoption of telematics solutions that monitor ecological conditions and fish populations. By utilizing telematics, fishing operators can make data-driven decisions that minimize their ecological footprint. This trend is likely to drive market growth, as more companies seek to align their operations with environmental sustainability goals, potentially increasing the market size by 12% in the coming years.