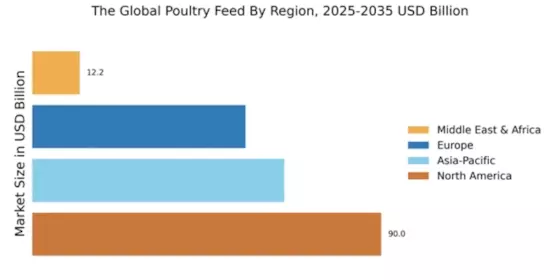

North America : Established Market Leaders

North America is a significant player in The Global Poultry Feed, holding a market size of $40.0 million. The region benefits from advanced agricultural practices, high demand for poultry products, and a focus on sustainable feed solutions. Regulatory support for animal health and nutrition further drives growth, as consumers increasingly seek quality and safety in food products. The market is expected to grow steadily, driven by innovations in feed formulations and nutritional enhancements.

The United States dominates the North American market, with key players like Cargill, Archer Daniels Midland, and Alltech leading the charge. These companies are investing in research and development to create more efficient and sustainable feed options. The competitive landscape is characterized by a mix of large corporations and regional players, all striving to meet the evolving demands of poultry producers and consumers alike.

Europe : Innovative Feed Solutions

Europe's poultry feed market, valued at $35.0 million, is characterized by a strong emphasis on sustainability and innovation. Regulatory frameworks, such as the EU's Farm to Fork Strategy, promote environmentally friendly practices and animal welfare, driving demand for high-quality feed. The region is witnessing a shift towards organic and non-GMO feed options, reflecting consumer preferences for healthier poultry products. This regulatory support is expected to enhance market growth in the coming years.

Leading countries in Europe include Germany, France, and the Netherlands, where companies like Nutreco and BASF are at the forefront of developing innovative feed solutions. The competitive landscape is robust, with numerous players focusing on research and development to meet regulatory standards and consumer demands. The presence of established firms and a growing number of startups contribute to a dynamic market environment, fostering continuous improvement in feed quality and sustainability.

Asia-Pacific : Rapid Expansion and Demand

Asia-Pacific is the largest regional market for poultry feed, with a staggering market size of $130.0 million. The region's growth is driven by increasing meat consumption, urbanization, and rising disposable incomes. Governments are also implementing policies to enhance food security, which boosts demand for poultry products. The focus on improving feed efficiency and nutritional value is critical, as producers seek to optimize production costs while meeting consumer expectations for quality.

Countries like China, India, and Thailand are leading the charge in this market, with significant investments in poultry farming and feed production. Key players such as Charoen Pokphand Foods and Alltech are expanding their operations to cater to the growing demand. The competitive landscape is marked by both local and international companies striving to innovate and provide high-quality feed solutions, ensuring the region remains a powerhouse in The Global Poultry Feed.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region, with a market size of $17.23 million, presents significant growth opportunities in the poultry feed sector. The increasing demand for poultry products, driven by population growth and urbanization, is a key growth driver. Additionally, governments are focusing on enhancing agricultural productivity and food security, which is expected to boost the poultry feed market. Regulatory initiatives aimed at improving animal health and nutrition are also contributing to market expansion.

Leading countries in this region include South Africa, Egypt, and Nigeria, where local and international players are investing in poultry feed production. Companies like De Heus and ForFarmers are actively participating in this market, focusing on developing tailored feed solutions to meet local needs. The competitive landscape is evolving, with a mix of established firms and new entrants striving to capture market share and address the growing demand for poultry products.