Orthopedic Biomaterial Market Summary

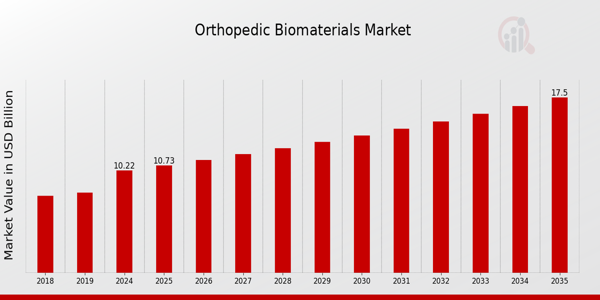

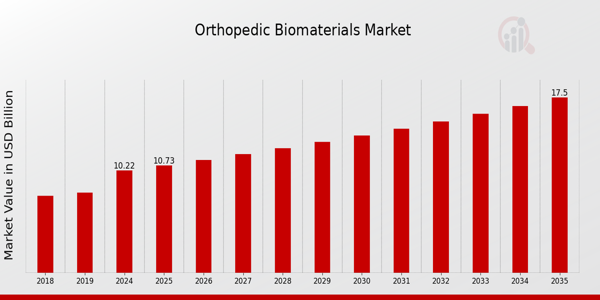

As per Market Research Future analysis, the Orthopedic Biomaterials Market was valued at 9.73 USD Billion in 2023 and is projected to reach 17.5 USD Billion by 2035, growing at a CAGR of 5.01% from 2025 to 2035. The market is driven by an increasing aging population, technological advancements in biomaterials, and a rising incidence of sports injuries, leading to a higher demand for orthopedic treatments.

Key Market Trends & Highlights

The Global Orthopedic Biomaterials Market is undergoing significant transformation due to various factors.

- The market is expected to grow from 10.22 USD Billion in 2024 to 17.5 USD Billion by 2035.

- The aging population will double from 12% to 22% between 2015 and 2050, increasing the demand for orthopedic treatments.

- Technological advancements in biomaterials, such as bioactive glasses, are enhancing the performance of orthopedic implants.

- The rising incidence of sports injuries in the U.S. has reached approximately 8.6 million annually, driving demand for orthopedic solutions.

Market Size & Forecast

2023 Market Size: USD 9.73 Billion

2024 Market Size: USD 10.22 Billion

2035 Market Size: USD 17.5 Billion

CAGR (2025-2035): 5.01%

Largest Regional Market Share in 2024: North America.

Major Players

Key companies include Zimmer Biomet, Smith and Nephew, DePuy Synthes, RTI Surgical, Amedica, Orthofix, Stryker, Collagen Solutions, Osseon, NuVasive, Heraeus Medical, Medtronic, Braun, CeramTec, Bioventus.

Key Orthopedic Biomaterials Market Trends Highlighted

The Orthopedic Biomaterials Market is shaped by several key market drivers. An increasing incidence of orthopedic diseases and injuries, coupled with an aging population, is propelling the demand for innovative biomaterials for orthopedic applications. Additionally, advancements in technology and materials science are enabling the development of more effective and biocompatible orthopedic solutions, which are vital in surgical procedures.

Opportunities to be explored lie in the research and development of new bioresorbable materials, which can minimize the need for surgical removal after the healing process. Furthermore, the rising interest in personalized medicine provides a unique avenue for the customization of orthopedic implants and devices, enhancing patient outcomes and satisfaction.Recent trends show that there is a growing interest in minimally invasive surgical techniques. This is because advanced biomaterials are used to speed up healing and shorten recovery times.

The growing popularity of hybrid biomaterials, which combine the best properties of different materials to improve functionality, shows that orthopedic solutions are becoming more advanced.

There is also a strong push toward sustainability in biomaterials. The focus is on making eco-friendly and biodegradable options that fit with global efforts to protect the environment, especially in areas that are actively promoting sustainable healthcare practices.

Overall, the Orthopedic Biomaterials Market is evolving rapidly, influenced by technological advancements and changing healthcare dynamics, presenting lucrative avenues for market players to capitalize on the changing landscape.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Orthopedic Biomaterials Market Drivers

Increasing Prevalence of Orthopedic Conditions

The Orthopedic Biomaterials Market is witnessing substantial growth due to the rising incidence of orthopedic conditions, including osteoarthritis and fractures, which are reported to affect over 600 million people globally. According to the World Health Organization, the global population of elderly individuals is expected to reach 1.5 billion by 2050, leading to a higher demand for orthopedic implants and solutions.

Established organizations such as the American Academy of Orthopaedic Surgeons (AAOS) are actively advocating for advancements in orthopedic treatments, contributing to the growth of the Orthopedic Biomaterials Market.

As healthcare facilities invest more in novel biomaterials for joint reconstruction and tissue engineering, the adoption of these advanced products will further stimulate market growth. The need for efficient and effective treatment solutions for the aging population will drive investments in Research and Development (R&D) activities, enhancing the capabilities of orthopedic biomaterials.

Technological Advancements in Biomaterials

The Orthopedic Biomaterials Market is experiencing a transformative phase driven by technological advancements in material science. Innovations such as bioactive ceramics and biodegradable polymers are not only improving the performance of orthopedic implants but are also minimizing the rejection rates. According to various industry reports, advancements in 3D printing technology for custom orthopedic implants are expected to revolutionize the market, allowing for personalized treatment options.Organizations like the American Institute for Medical and Biological Engineering (AIMBE) are highlighting the importance of these technologies, encouraging partnerships between academia and industry.

This synergy is leading to a surge in intellectual property filings related to orthopedic biomaterials, indicating a vibrant R&D environment that supports market expansion.

Government Initiatives and Funding

The Orthopedic Biomaterials Market is supported by various government initiatives aimed at enhancing healthcare infrastructure and funding for medical research. According to recent investments announced in national healthcare policies, funding for orthopedic research and development has increased significantly, with several countries allocating funds specifically for biomaterial-related projects. For instance, the National Institutes of Health (NIH) has prioritized funding for biomaterials research, which will potentially increase innovation in orthopedic applications.

This heightened focus on orthopedic biomaterials by the Global government bodies ensures that researchers and companies have the resources needed to develop advanced solutions, thus fostering growth within the market.

Increasing Demand for Minimally Invasive Surgical Procedures

The Orthopedic Biomaterials Market is witnessing a significant shift towards minimally invasive surgical procedures, driven by patient preferences for quicker recovery times and reduced hospital stays. Studies indicate that minimally invasive techniques result in 30% faster recovery compared to traditional surgeries.

This trend is prompting orthopedic surgeons to opt for advanced biomaterials that align with these procedures. Renowned healthcare institutions and professional organizations are endorsing these techniques, highlighting the effective application of biomaterials in supporting minimally invasive surgeries.

The emphasis on improved surgical outcomes through innovative biomaterials will strengthen their adoption in orthopedic practices globally, thus propelling market growth.

Orthopedic Biomaterials Market Segment Insights

Orthopedic Biomaterials Market Type Insights

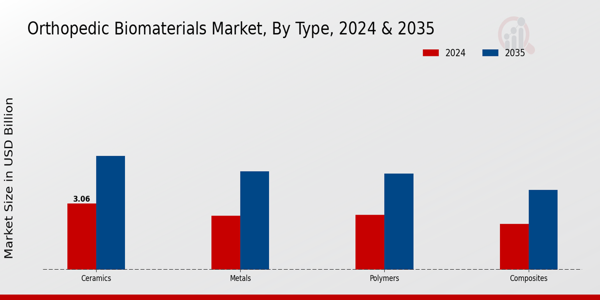

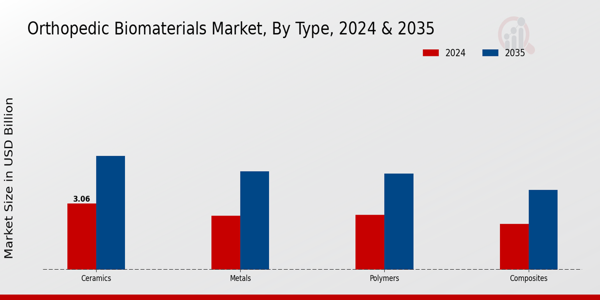

The Orthopedic Biomaterials Market, categorized by Type, reveals a diverse array of options that are integral to the healthcare industry. In 2024, the overall market is expected to exhibit strong growth, with significant valuations across various types of biomaterials. Ceramics, recognizing a value of 3.06 USD billion in 2024, play a critical role due to their biocompatibility and strength.

By 2035, this segment is projected to grow to 5.25 USD billion, showcasing ceramics' capability to withstand mechanical stress, making them ideal for load-bearing applications in orthopedic procedures.On the other hand, the Polymers segment is anticipated to be valued at 2.54 USD billion in 2024 and is expected to increase to 4.43 USD billion by 2035. Polymers are renowned for their flexibility and versatility, providing innovative solutions that cater to a range of orthopedic applications, including soft tissue repair and fixation devices.

Moreover, Composites are valued at 2.12 USD Billion in 2024, projected to expand to 3.68 USD billion by 2035. This segment combines the strengths of different materials, creating composites that offer tailored mechanical properties, making them significant in advanced orthopedic applications.Finally, the Metals segment, valued at 2.5 USD Billion in 2024, is expected to reach 4.54 USD billion by 2035. The robustness of metals makes them a prominent choice for implants, showcasing their ability to integrate with bone structures and provide long-term stability.

Collectively, these types contribute to the evolving landscape of the Orthopedic Biomaterials Market, reflecting ongoing trends toward innovation and improved patient outcomes, driven by the constant demand for advanced medical solutions across the globe.

The market dynamics are favorable, as technology advances and material science progress, heightening the relevance of each sub-segment in catering to specific orthopedic needs.Each type holds unique advantages that meet varying clinical requirements, positioning them crucially within the broader scope of orthopedic biomaterials.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Orthopedic Biomaterials Market Application Insights

The Orthopedic Biomaterials Market focuses significantly on various applications, including Bone Grafting, Joint Reconstruction, Spinal Fusion, and Fracture Repair, which play essential roles in patient recovery and enhancement of surgical outcomes. As of 2024, the overall market is projected to be valued at 10.22 USD billion, highlighting the critical importance of these applications in addressing orthopedic challenges.

Bone Grafting remains significant due to its ability to promote healing and regenerate bone structures, thus supporting a large patient demographic.Joint Reconstruction is vital for restoring mobility in patients with degenerative joint diseases, while Spinal Fusion has become increasingly prevalent, driven by a rise in spinal disorders and related surgeries globally. On the other hand, Fracture Repair contributes extensively to the market, given the high incidence of fractures in various age groups.

With an expected increase in demand propelled by an aging population and the prevalence of chronic diseases, the Orthopedic Biomaterials Market data suggests a promising future for these applications, reflecting the ongoing trends in healthcare advancements and technological innovations.

This segmentation emphasizes the adaptive nature of orthopedic solutions to meet diverse patient needs, further enhancing the market’s growth trajectory in the coming years.

Orthopedic Biomaterials Market End User Insights

The Orthopedic Biomaterials Market showcases a diverse landscape, particularly in the End User segment, which comprises Hospitals, Orthopedic Clinics, and Ambulatory Surgical Centers. By 2024, this market is expected to reach a valuation of 10.22 USD billion, highlighting its expanding significance in the healthcare sector.

Hospitals dominate a considerable portion of this segment, primarily due to their comprehensive services and advanced infrastructure, ensuring a steady demand for orthopedic procedures and materials. Orthopedic Clinics also play a crucial role, focusing on specialized care and treatments, attracting a patient base seeking targeted therapies.

Meanwhile, Ambulatory Surgical Centers are becoming increasingly significant, offering cost-effective and efficient surgical options that cater to a growing preference for outpatient care. The evolution of patient-centric care and advancements in orthopedic biomaterials are driving the market growth, supported by increasing injury incidences and an aging population.

However, challenges such as regulatory hurdles and the need for continual innovation in biomaterials present hurdles that must be navigated. Overall, the Orthopedic Biomaterials Market segmentation underscores the critical importance of these End Users in shaping the industry landscape.

Orthopedic Biomaterials Market Form Insights

The Orthopedic Biomaterials Market, particularly in the Form segment, plays a crucial role in the overall industry dynamics. By 2024, the market was valued at 10.22 USD billion, reflecting significant growth in various product forms such as Granules, Putty, Sheets, and Blocks.

Granules are increasingly preferred for their versatility and ease of use in various applications, while Putty is recognized for its excellent handling properties and ability to fill voids. Sheets are gaining traction for their structural integrity in medical devices, and Blocks are favored for their strength in load-bearing applications.As these forms cater to distinct orthopedic needs, they represent an essential aspect of the Orthopedic Biomaterials Market revenue. The continuous advancements in material science and growing orthopedic surgeries are pivotal drivers behind this market's expansion.

Furthermore, the increasing aging population and rising prevalence of orthopedic disorders contribute to the heightened demand for these biomaterials.

However, challenges such as stringent regulatory processes and material compatibility issues could affect market growth. Overall, the Form segment is central to the resilience and adaptability of the Orthopedic Biomaterials Market.

Orthopedic Biomaterials Market Regional Insights

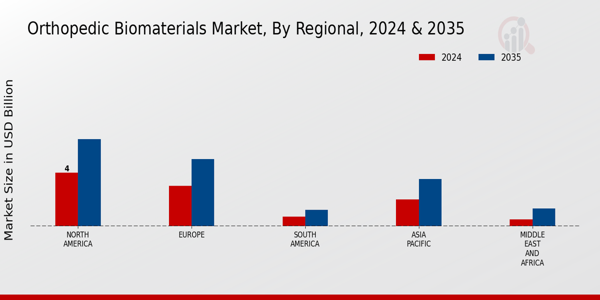

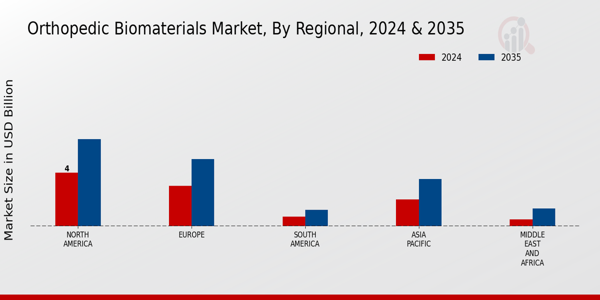

The Orthopedic Biomaterials Market is characterized by diverse regional dynamics, with North America leading the market, valued at 4.0 USD billion in 2024 and expected to reach 6.5 USD billion by 2035. This region's dominance can be attributed to advanced healthcare infrastructure and a high incidence of orthopedic conditions.

Europe follows with a market valuation of 3.0 USD Billion in 2024 and a forecasted growth to 5.0 USD billion by 2035, supported by strong R&D initiatives and governmental health policies promoting advanced medical solutions.In South America, the market is valued at 0.7 USD Billion in 2024, projected to increase to 1.2 USD billion by 2035, driven by healthcare improvements and rising awareness. The Asia Pacific region is estimated to be valued at 2.0 USD Billion in 2024 and 3.5 USD billion by 2035, reflecting rapid economic development and increasing demand for innovative orthopedic solutions.

Lastly, the Middle East and Africa represent a smaller segment, with market values of 0.5 USD billion in 2024 and a projected 1.3 USD billion in 2035, as emerging markets in this region focus on enhancing their healthcare capabilities.

These insights reflect the overall market growth and potential across different regions within the Orthopedic Biomaterials Market, highlighting both opportunities and challenges each faces.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Orthopedic Biomaterials Market Key Players and Competitive Insights

The Orthopedic Biomaterials Market is characterized by its rapid evolution, driven by advancements in technology, increasing patient demand, and innovations in materials science. This market includes a range of products designed to support bone healing and repair, including synthetic materials, biologics, and implants. Competition within this sector is intense, with various players striving to differentiate their products through innovation, quality, and efficacy.

Companies invest significantly in research and development to create next-generation biomaterials that are biocompatible, durable, and optimized for specific orthopedic applications. The landscape is continually reshaped by mergers and acquisitions, partnerships, and collaborations among key stakeholders, which add to the competitive dynamics.Orthofix holds a strong position in the Orthopedic Biomaterials Market due to its focus on innovative solutions for spinal and extremity conditions. The company’s strengths lie in its extensive research and development efforts, which enable it to introduce cutting-edge products that enhance surgical outcomes and improve recovery times for patients.

Orthofix's robust product portfolio features numerous biomaterials specifically designed for orthopedic applications, contributing to its strong market presence.

The company further strengthens its competitive edge by maintaining strategic partnerships and collaborations, enhancing its distribution channels worldwide. This broadens its reach and allows Orthofix to tap into emerging markets, catering to diverse patient needs with its advanced orthopedic solutions.

DePuy Synthes, a subsidiary of a global healthcare leader, has made a significant mark in the Orthopedic Biomaterials Market with its comprehensive range of products and services tailored to support orthopedic surgeons around the world. The company focuses on creating innovative implant systems, including those utilizing advanced biomaterials designed to facilitate bone healing and regeneration.

Key products associated with DePuy Synthes include successful orthopedic implants and fixation solutions that consistently demonstrate high quality and efficacy. Its strong market presence is bolstered by ongoing investments in research and development, aimed at pioneering new techniques and materials in orthopedic surgery.

Additionally, DePuy Synthes has strategically navigated mergers and acquisitions to expand its capabilities and product offerings, solidifying its position as a leader in the global orthopedic biomaterials sector. Through these strategies, the company continually enhances its competitive advantages while addressing the evolving needs of healthcare providers and patients on a global scale.

Key Companies in the Orthopedic Biomaterials Market Include

- Orthofix

- DePuy Synthes

- Stryker

- Aesculap

- Smith & Nephew

- Zimmer Biomet

- Heraeus

- Eden Biologics

- Medtronic

- Johnson & Johnson

- NuVasive

- L. Gore & Associates

Orthopedic Biomaterial Market Industry Developments

-

Q2 2024: Zimmer Biomet Announces Launch of ZBEdge Dynamic Intelligence Platform for Orthopedic Surgery Zimmer Biomet launched its ZBEdge Dynamic Intelligence platform, integrating smart biomaterials and data analytics to enhance orthopedic surgical outcomes. The platform aims to improve implant longevity and patient recovery through real-time data integration.

-

Q2 2024: Stryker Receives FDA Clearance for New Bioactive Bone Graft Material Stryker announced FDA clearance for its latest bioactive bone graft material designed for spinal and trauma surgeries, marking a significant regulatory milestone in orthopedic biomaterials innovation.

-

Q3 2024: DePuy Synthes Launches Next-Generation Biodegradable Polymer for Joint Reconstruction DePuy Synthes, a Johnson & Johnson company, launched a new biodegradable polymer for joint reconstruction, aiming to reduce long-term complications and improve tissue integration in orthopedic procedures.

-

Q3 2024: Smith & Nephew Acquires OrthoBioTech for $250 Million to Expand Biomaterials Portfolio Smith & Nephew completed the acquisition of OrthoBioTech, a developer of advanced orthopedic biomaterials, to strengthen its product offerings in bone repair and joint reconstruction.

-

Q4 2024: Globus Medical Opens New Biomaterials Manufacturing Facility in Pennsylvania Globus Medical inaugurated a state-of-the-art manufacturing facility dedicated to orthopedic biomaterials, increasing production capacity and supporting innovation in implantable materials.

-

Q4 2024: Medtronic Announces Strategic Partnership with Evonik Industries for Advanced Polymer Development Medtronic entered a strategic partnership with Evonik Industries to co-develop next-generation polymers for orthopedic implants, focusing on improved biocompatibility and mechanical strength.

-

Q1 2025: NuVasive Launches Porous Titanium Biomaterial for Spinal Fusion Procedures NuVasive introduced a new porous titanium biomaterial designed to enhance bone growth and fusion rates in spinal surgeries, expanding its biomaterials product line.

-

Q1 2025: Wright Medical Group Appoints New CEO to Drive Biomaterials Innovation Wright Medical Group announced the appointment of a new CEO, emphasizing a renewed focus on research and development in orthopedic biomaterials and regenerative medicine.

-

Q2 2025: Invibio Ltd. Secures $100 Million Contract with Major US Hospital Network for PEEK Biomaterial Implants Invibio Ltd. signed a $100 million supply contract with a leading US hospital network to provide PEEK-based biomaterial implants for orthopedic surgeries over the next five years.

-

Q2 2025: Braun Melsungen AG Announces $75 Million Investment in Orthopedic Biomaterials R&D Braun Melsungen AG committed $75 million to expand its research and development efforts in orthopedic biomaterials, targeting new product launches and clinical trials through 2026.

-

Q3 2025: Evonik Industries Unveils New Biodegradable Composite for Trauma Fixation Devices Evonik Industries launched a novel biodegradable composite material for trauma fixation devices, aiming to reduce the need for secondary surgeries and improve patient outcomes.

-

Q3 2025: Globus Medical Wins Major European Tender for Orthopedic Biomaterial Implants Globus Medical secured a significant contract to supply orthopedic biomaterial implants to several European hospitals, expanding its international market presence.

Orthopedic Biomaterials Market Segmentation Insights

Orthopedic Biomaterials Market Type Outlook

- Ceramics

- Polymers

- Composites

- Metals

Orthopedic Biomaterials Market Application Outlook

- Bone Grafting

- Joint Reconstruction

- Spinal Fusion

- Fracture Repair

Orthopedic Biomaterials Market End User Outlook

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

Orthopedic Biomaterials Market Form Outlook

- Granules

- Putty

- Sheets

- Blocks

Orthopedic Biomaterials Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

9.73 (USD Billion)

|

|

Market Size 2024

|

10.22 (USD Billion)

|

|

Market Size 2035

|

17.5 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

5.01% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Orthofix, DePuy Synthes, Stryker, Aesculap, Smith & Nephew, Zimmer Biomet, Heraeus, Eden Biologics, Medtronic, Johnson & Johnson, NuVasive, W. L. Gore & Associates

|

|

Segments Covered

|

Type, Application, End User, Form, Regional

|

|

Key Market Opportunities

|

Growing elderly population demand, Advancements in regenerative medicine, Increase in sports injuries, Rising acceptance of minimally invasive procedures, Expanding applications in orthopedic surgeries

|

|

Key Market Dynamics

|

Rising elderly population, Increasing orthopedic surgeries, Advancements in biomaterials technology, Growing demand for minimally invasive procedures, Enhanced healthcare expenditure

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Orthopedic Biomaterial Market Highlights:

Frequently Asked Questions (FAQ):

In 2024, the Orthopedic Biomaterials Market is expected to be valued at 10.22 USD billion.

By 2035, the market is projected to reach a value of 17.5 USD billion.

The expected CAGR for the market from 2025 to 2035 is 5.01%.

By 2035, North America is expected to have the largest market share, valued at 6.5 USD billion.

The ceramics segment is expected to be valued at 5.25 USD billion by 2035.

Major players include Orthofix, DePuy Synthes, Stryker, Aesculap, and Smith & Nephew, among others.

The metals segment is expected to be valued at 2.5 USD Billion in 2024.

The Asia Pacific region is projected to reach a market size of 3.5 USD billion by 2035.

Emerging trends are likely to present new opportunities for growth and innovation in the market.

The composites segment is expected to be valued at 3.68 USD billion by 2035.