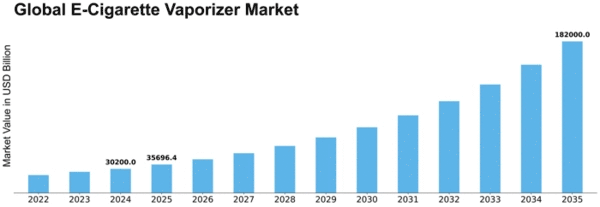

Global E Cigarette Vaporizer Size

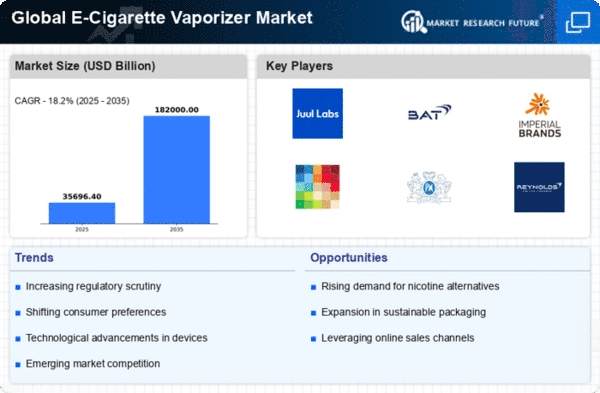

Global E-Cigarette Vaporizer Market Growth Projections and Opportunities

The E-Cigarettes & Vaporizer Market is influenced by a myriad of factors that collectively contribute to its growth, trends, and overall dynamics. One of the primary drivers is the increasing global concern over traditional tobacco consumption. Despite widespread awareness campaigns and government initiatives highlighting the health risks associated with smoking, consumers addicted to tobacco often struggle to quit. This predicament has created a significant demand for alternatives to traditional tobacco, spurring the growth of the E-Cigarettes and vaporizer market.

In addition to the consumer behavior, the market is driven by the shifting consumer preferences and lifestyles. More and more people place health and well-being on the pedestal. They turn to herbs as safer way of inhaling nicotine. The trendy way of nicotine consumption by e-cigarettes or vaporizers appears as a more mainstream, modern and technologically advanced alternative to traditional smoking.

Global communities are facing a huge task of controlling tobacco consumption, even though many governments are in the race to alert people to the attendant health risks. People who have become addicted to tobacco often come across many difficulties in quitting this addiction and seek alternatives which are effective. Thus, this increasing demand for replacement to conventional tobacco has entrenched as the key driver moderating the growth of the E-Cigarettes and vaporizer market.

Regulatory efforts and government policies represent one of the important factors that have an impact on the grow of the E-Cigarettes & Vaporizer Market. The e-cigarette and vaporizer regulatory environment differs by country and also changes across borders. Changes in laws also affect market dynamics. Despite this, some areas has declared these products as smoking cessation aids whereas the others had strict regulations or an outright ban. Regulatory Issues are to be monitored and adapted to constantly as this is one of the essential factors to be considered by market players in such industry.

Through technological development, the market progresses and develops. The new designs and functionality updates in electronic cigarette and vaporizer devices increase the users' experience satisfaction, thus vaping becomes more interesting to the target consumers. Technological advances too give rise to inventions of new and even improved vaping gadgets, flavors and accessories that in turn fuels demand for such products.

A major attribute of vaping culture's social element and the flavored e-liquids' attraction is what explains the appeal of the market. Under many smokers vaping has become a lifestyle product, and the variety of flavors create a personalized and playful vaping experience.

Market competition together with players create variety and innovations. The companies pursue technological advancement and fashionability as they compete for market share, and they invest in the research and development of such products. Such competitive landscape encourages a consistent roll-out of new products, flavors, and features on the part of the companies, thus a consumer has a wide range of choices to pick from and the market will continually operate in the dynamism.

Economic factors also influence the E-Cigarettes & Vaporizer Market. Affordability, pricing strategies, and accessibility impact consumer choices. The cost-effectiveness of vaping compared to traditional smoking and the availability of various price points contribute to the market's appeal, particularly among budget-conscious consumers.

Leave a Comment