Innovative Marketing Strategies

The cigarette Market is adapting to changing consumer preferences through innovative marketing strategies. Companies are increasingly utilizing digital platforms and social media to reach younger demographics, which may enhance brand loyalty and attract new smokers. The introduction of lifestyle branding, which associates smoking with aspirational values, appears to resonate well with consumers. Additionally, the use of targeted advertising campaigns has been shown to increase market penetration. According to recent data, companies that invest in innovative marketing techniques have reported a 15% increase in sales over the past year, indicating that effective marketing is a crucial driver for the Cigarette Market.

Regulatory Changes and Compliance

The Cigarette Market is significantly influenced by regulatory changes and compliance requirements. Governments worldwide are implementing stricter regulations on tobacco advertising, packaging, and sales, which can impact market dynamics. For instance, the introduction of plain packaging laws in several countries has altered how brands communicate with consumers. While these regulations aim to reduce smoking rates, they also create challenges for manufacturers in maintaining market share. Compliance with these regulations often requires substantial investment, which can affect profitability. Nevertheless, companies that successfully navigate these regulatory landscapes may find opportunities to differentiate themselves in the Cigarette Market.

Health Awareness and Anti-Smoking Campaigns

The Cigarette Market faces ongoing challenges from health awareness and anti-smoking campaigns. Public health initiatives aimed at reducing smoking rates have gained momentum, leading to increased awareness of the health risks associated with tobacco use. This trend has resulted in a decline in smoking prevalence in certain demographics, particularly among younger individuals. Data indicates that countries with robust anti-smoking campaigns have seen a 20% reduction in smoking rates over the past decade. Consequently, the Cigarette Market must adapt to these changing consumer attitudes, potentially leading to a shift in product offerings and marketing strategies to remain relevant.

Emergence of E-Cigarettes and Vaping Products

The Cigarette Market is witnessing a transformative shift with the emergence of e-cigarettes and vaping products. These alternatives are gaining popularity among smokers seeking less harmful options. The convenience and perceived reduced health risks associated with vaping have attracted a new consumer base, particularly among younger adults. Market data suggests that e-cigarette sales have surged, accounting for approximately 30% of the total tobacco market in certain regions. This trend indicates a potential decline in traditional cigarette consumption, compelling manufacturers in the Cigarette Market to diversify their product lines to include these alternatives, thereby ensuring sustained growth.

Increasing Tobacco Consumption in Emerging Markets

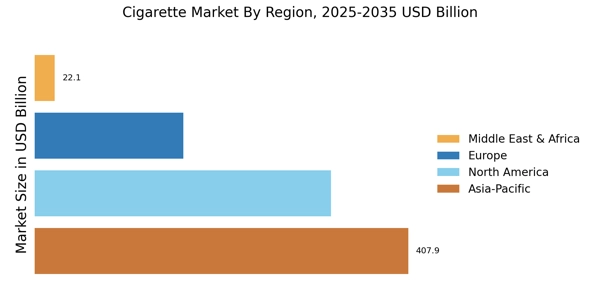

The Cigarette Market is experiencing a notable increase in tobacco consumption, particularly in emerging markets. Countries in Asia and Africa are witnessing a rise in smoking prevalence due to urbanization and changing lifestyles. For instance, the World Health Organization reported that tobacco use in low- and middle-income countries is projected to grow, driven by population growth and economic development. This trend suggests that the Cigarette Market may see a significant uptick in demand as these regions continue to develop economically. Furthermore, the affordability of cigarettes in these markets, compared to developed nations, could lead to higher consumption rates, thereby bolstering the overall market growth.