Emergence of Smart Cities

The emergence of smart cities is driving innovation and growth within the Gigabit Interface Converter Market. As urban areas increasingly adopt smart technologies to improve infrastructure and services, the demand for high-speed data transmission becomes critical. Smart city initiatives often involve the integration of various technologies, including IoT, big data, and cloud computing, all of which require robust networking solutions. The investment in smart city projects is projected to reach significant levels, necessitating the deployment of gigabit interface converters to ensure seamless connectivity. This trend not only enhances urban living but also creates a fertile ground for the growth of the Gigabit Interface Converter Market, as municipalities and organizations seek to implement advanced networking solutions.

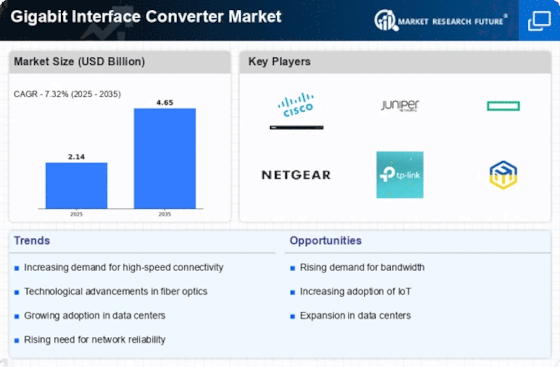

Expansion of Data Centers

The expansion of data centers is significantly influencing the Gigabit Interface Converter Market. As organizations increasingly rely on cloud services and big data analytics, the need for robust data center infrastructure has escalated. This expansion necessitates the deployment of advanced networking equipment, including gigabit interface converters, to ensure efficient data flow and connectivity. Recent statistics indicate that the data center market is projected to grow substantially, with investments in infrastructure reaching unprecedented levels. This growth is likely to drive demand for gigabit interface converters, as they play a crucial role in optimizing network performance and supporting high-capacity data transmission. Thus, the Gigabit Interface Converter Market stands to benefit from this ongoing trend.

Increased Adoption of 5G Technology

The increased adoption of 5G technology is a pivotal factor propelling the Gigabit Interface Converter Market. As telecommunications companies roll out 5G networks, the demand for high-speed data transmission solutions intensifies. 5G technology promises significantly faster speeds and lower latency, which necessitates the use of advanced networking equipment, including gigabit interface converters. This transition is not merely a trend; it represents a fundamental shift in how data is transmitted and consumed. Market analysis suggests that the 5G rollout will create substantial opportunities for the gigabit interface converter market, as businesses and consumers alike seek to leverage the benefits of enhanced connectivity. Therefore, the Gigabit Interface Converter Market is likely to experience robust growth in response to this technological advancement.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is a primary driver of the Gigabit Interface Converter Market. As businesses and consumers alike seek faster internet speeds, the need for efficient data transmission becomes paramount. This trend is particularly evident in sectors such as telecommunications and data centers, where the requirement for high bandwidth is critical. According to recent data, the demand for gigabit services has surged, with many service providers upgrading their infrastructure to meet this need. This shift not only enhances user experience but also drives the adoption of gigabit interface converters, which facilitate seamless data transfer. Consequently, the Gigabit Interface Converter Market is poised for growth as organizations invest in technology that supports high-speed connectivity.

Growing Internet of Things (IoT) Ecosystem

The growing Internet of Things (IoT) ecosystem is a significant driver of the Gigabit Interface Converter Market. As more devices become interconnected, the demand for reliable and high-speed data transmission solutions escalates. IoT applications, ranging from smart homes to industrial automation, require efficient networking capabilities to function optimally. The proliferation of IoT devices is expected to reach billions in the coming years, creating a substantial market for gigabit interface converters that can support the necessary bandwidth. This trend indicates a shift towards more sophisticated networking solutions, as organizations seek to enhance their operational efficiency and connectivity. Consequently, the Gigabit Interface Converter Market is well-positioned to capitalize on the expanding IoT landscape.