Aging Population and Mobility Needs

The aging population in Germany is a crucial driver for the wheelchair market. As the demographic shifts, the demand for mobility aids, including wheelchairs, is expected to rise significantly. By 2030, it is projected that over 25% of the German population will be aged 65 and older, leading to an increased prevalence of mobility impairments. This demographic trend suggests that the wheelchair market will experience substantial growth, as older adults often require specialized mobility solutions. Furthermore, the German government has been actively promoting accessibility initiatives, which may further stimulate demand for wheelchairs. The combination of an aging population and supportive policies indicates a robust market potential for wheelchair manufacturers and suppliers in Germany.

Rising Awareness of Disability Rights

In recent years, there has been a notable increase in awareness regarding disability rights in Germany. This societal shift is influencing the wheelchair market positively. Advocacy groups and non-profit organizations are actively promoting the rights of individuals with disabilities, leading to greater demand for accessible products, including wheelchairs. The German government has implemented various regulations to enhance accessibility in public spaces, which may further drive the need for innovative wheelchair solutions. As awareness continues to grow, it is likely that consumers will seek out high-quality, adaptive wheelchairs that cater to diverse needs. This trend suggests a promising outlook for the wheelchair market, as manufacturers respond to the evolving demands of a more inclusive society.

Government Support and Funding Initiatives

Government support and funding initiatives are significant drivers of the wheelchair market in Germany. The German government has established various programs aimed at improving accessibility for individuals with disabilities. Financial assistance for purchasing mobility aids, including wheelchairs, is available through health insurance and social welfare programs. This financial support encourages individuals to invest in high-quality wheelchairs that meet their specific needs. Furthermore, the government is actively promoting research and development in the mobility sector, which may lead to innovative solutions in the wheelchair market. As funding initiatives continue to expand, it is likely that the market will experience sustained growth, benefiting both consumers and manufacturers.

Technological Advancements in Mobility Solutions

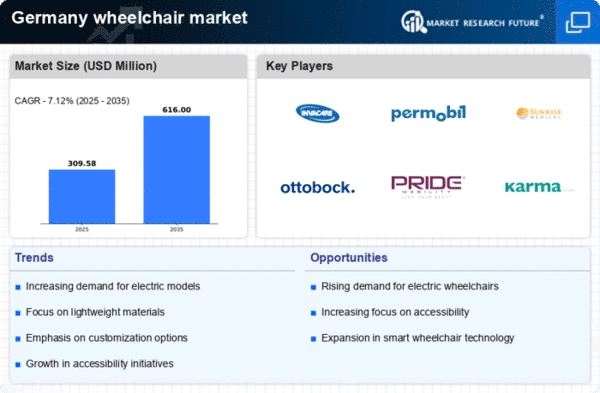

Technological advancements are playing a pivotal role in shaping the wheelchair market in Germany. Innovations such as electric wheelchairs, smart mobility devices, and advanced materials are enhancing the functionality and comfort of wheelchairs. The integration of technology into mobility solutions is not only improving user experience but also expanding the market reach. For instance, the introduction of lightweight materials has made wheelchairs more portable and easier to maneuver. Additionally, the market for electric wheelchairs is projected to grow at a CAGR of approximately 8% over the next five years, indicating a strong trend towards more sophisticated mobility aids. These advancements suggest that the wheelchair market is evolving rapidly, driven by consumer demand for enhanced features and performance.

Increased Focus on Rehabilitation and Healthcare Services

The increased focus on rehabilitation and healthcare services in Germany is driving the wheelchair market. As healthcare systems evolve, there is a growing emphasis on providing comprehensive rehabilitation services for individuals with mobility challenges. Hospitals and rehabilitation centers are increasingly incorporating advanced wheelchair solutions into their patient care protocols. This trend is supported by a rising number of individuals seeking rehabilitation services, which is projected to increase by 15% over the next decade. The integration of wheelchairs into rehabilitation programs not only enhances patient outcomes but also stimulates demand for innovative wheelchair designs. Consequently, this focus on healthcare services is likely to contribute positively to the growth of the wheelchair market in Germany.