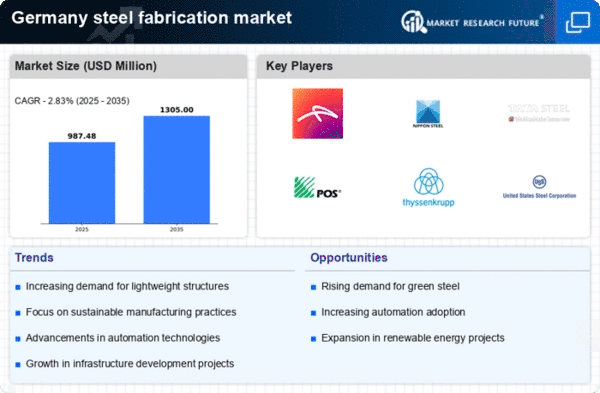

The steel fabrication market in Germany exhibits a dynamic competitive landscape characterized by a blend of innovation, strategic partnerships, and a focus on sustainability. Key players such as Thyssenkrupp AG (Germany), ArcelorMittal (Luxembourg), and Tata Steel (India) are actively shaping the market through their distinct operational strategies. Thyssenkrupp AG (Germany) emphasizes digital transformation and sustainability, aiming to reduce carbon emissions by 30% by 2030. Meanwhile, ArcelorMittal (Luxembourg) focuses on expanding its green steel initiatives, which positions it favorably in a market increasingly driven by environmental considerations. Tata Steel (India) is also enhancing its presence in Germany through strategic acquisitions and partnerships, thereby reinforcing its competitive stance in the region.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure appears moderately fragmented, with several players vying for market share while also collaborating on sustainability initiatives. This collective influence of key players fosters a competitive environment where innovation and operational efficiency are paramount.

In September Thyssenkrupp AG (Germany) announced a partnership with a leading technology firm to develop advanced AI-driven solutions for steel production. This strategic move is likely to enhance operational efficiency and reduce costs, thereby solidifying Thyssenkrupp's position as a leader in the digital transformation of the steel fabrication sector. The integration of AI technologies may also facilitate better resource management and predictive maintenance, which are crucial for maintaining competitiveness in a rapidly evolving market.

In October ArcelorMittal (Luxembourg) launched a new line of low-carbon steel products aimed at meeting the growing demand for sustainable materials. This initiative not only aligns with The steel fabrication market. The introduction of these products is expected to attract environmentally conscious clients and enhance the company's market share in Germany, where regulatory pressures for sustainability are intensifying.

In August Tata Steel (India) completed the acquisition of a local steel fabrication company in Germany, which is anticipated to bolster its operational capabilities and market reach. This acquisition reflects Tata Steel's commitment to expanding its footprint in Europe and enhancing its competitive edge through localized production. By integrating local expertise and resources, Tata Steel is likely to improve its supply chain efficiency and responsiveness to market demands.

As of November the competitive trends in the steel fabrication market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaborative efforts towards achieving sustainability goals. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market dynamics.