Growing Demand for Customization

The smartphone operating-system market in Germany experiences a notable surge in demand for customization options. Users increasingly seek personalized interfaces and functionalities that cater to their individual preferences. This trend is reflected in the rising popularity of operating systems that allow extensive user modifications. According to recent data, approximately 45% of German smartphone users express a desire for more customizable features in their devices. This inclination towards personalization drives developers to innovate and enhance their offerings, thereby fostering competition within the smartphone operating-system market. As a result, companies are investing in research and development to create more adaptable platforms, which may lead to a more diverse range of operating systems available to consumers.

Increased Focus on User Experience

User experience has emerged as a pivotal driver in the smartphone operating-system market in Germany. Consumers are increasingly discerning about the usability and intuitiveness of their devices. This trend has led to a heightened emphasis on designing operating systems that prioritize user-friendly interfaces and streamlined navigation. Recent surveys indicate that 70% of German smartphone users consider ease of use a critical factor when selecting an operating system. Consequently, developers are investing in user research and testing to refine their platforms, ensuring they meet the evolving expectations of consumers. This focus on user experience not only enhances customer satisfaction but also fosters brand loyalty, which is essential for sustained growth in the competitive smartphone operating-system market.

Advancements in Mobile Connectivity

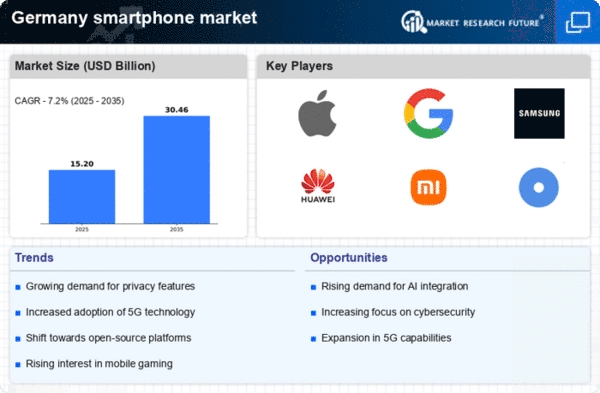

The smartphone operating-system market in Germany is significantly influenced by advancements in mobile connectivity technologies. The rollout of 5G networks has transformed user expectations regarding speed and performance. With 5G, users anticipate seamless streaming, faster downloads, and improved overall device responsiveness. This shift compels operating system developers to optimize their platforms for enhanced connectivity features. Recent statistics indicate that 5G adoption in Germany is projected to reach 60% by the end of 2025, prompting a corresponding evolution in the smartphone operating-system market. As developers adapt to these changes, they are likely to introduce new functionalities that leverage the capabilities of 5G, thereby enhancing user experiences and driving market growth.

Integration of Emerging Technologies

The smartphone operating-system market in Germany is increasingly shaped by the integration of emerging technologies such as augmented reality (AR) and virtual reality (VR). As these technologies gain traction, operating systems are evolving to support new applications and functionalities that enhance user engagement. For instance, the incorporation of AR features into operating systems allows users to interact with their environment in innovative ways. Market analysis suggests that the demand for AR-enabled applications is expected to grow by 30% in the coming years. This trend compels operating system developers to adapt their platforms to accommodate these advancements, thereby driving innovation within the smartphone operating-system market and attracting tech-savvy consumers.

Regulatory Compliance and Data Privacy

Regulatory compliance and data privacy concerns are increasingly influencing the smartphone operating-system market in Germany. With the implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), operating system developers must prioritize user privacy and data security. This regulatory landscape compels companies to enhance their operating systems with robust security features and transparent data handling practices. Recent reports indicate that 80% of German consumers are more likely to choose an operating system that prioritizes data privacy. As a result, developers are investing in compliance measures and security enhancements, which not only align with regulatory requirements but also build consumer trust in the smartphone operating-system market.