Focus on Energy Management Solutions

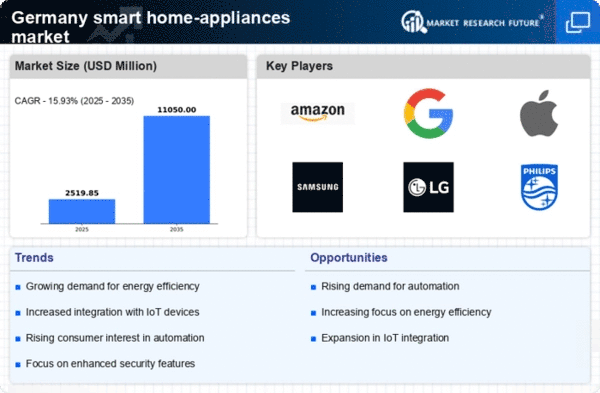

The emphasis on energy management solutions significantly influences the smart home-appliances market in Germany. With rising energy costs and increasing environmental awareness, consumers are actively seeking appliances that offer energy-saving features. Recent statistics suggest that around 40% of German consumers prioritize energy efficiency when purchasing new appliances. This trend is reflected in the growing availability of smart appliances that provide real-time energy consumption data, enabling users to make informed decisions about their usage. Additionally, government initiatives aimed at promoting energy efficiency and sustainability further bolster this focus. As a result, manufacturers are increasingly incorporating advanced energy management technologies into their products, thereby enhancing their appeal in the competitive smart home-appliances market.

Rising Consumer Demand for Automation

the smart home-appliances market in Germany is experiencing a notable surge in consumer demand for automation solutions.. As households increasingly seek convenience and efficiency, the adoption of smart appliances is on the rise. Recent data indicates that approximately 35% of German households have integrated at least one smart appliance into their daily routines. This trend is driven by the desire for enhanced control over home environments, allowing users to manage appliances remotely via smartphones or voice commands. The growing awareness of the benefits of automation, such as time savings and improved energy management, further propels this demand. Consequently, manufacturers are compelled to innovate and expand their product offerings to cater to this evolving consumer preference, thereby shaping the landscape of the smart home-appliances market in Germany.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into smart home appliances is transforming the market landscape in Germany. AI technologies enable appliances to learn user preferences and adapt their functionalities accordingly, enhancing user experience and convenience. As of November 2025, it is estimated that nearly 25% of smart appliances in Germany incorporate AI features, allowing for personalized interactions and improved efficiency. This trend is particularly evident in devices such as smart thermostats and refrigerators, which can optimize energy usage based on user habits. The growing acceptance of AI-driven solutions among consumers suggests a shift towards more intelligent home environments, thereby driving innovation and competition within the smart home-appliances market.

Technological Advancements in Connectivity

Technological advancements play a pivotal role in shaping the smart home-appliances market in Germany. The proliferation of Internet of Things (IoT) technology has enabled seamless connectivity between devices, enhancing user experience and functionality. As of November 2025, it is estimated that over 60% of new appliances sold in Germany are equipped with IoT capabilities, allowing for real-time monitoring and control. This connectivity not only facilitates remote operation but also enables appliances to communicate with each other, creating a more integrated home ecosystem. The continuous evolution of wireless technologies, such as 5G, further enhances the potential for smart appliances to operate efficiently and reliably. As consumers become more accustomed to these innovations, the demand for connected appliances is likely to grow, driving further investment and development within the smart home-appliances market.

Government Support for Smart Home Initiatives

Government support for smart home initiatives plays a crucial role in the development of the smart home-appliances market in Germany. Various policies and funding programs are designed to encourage the adoption of smart technologies, particularly in residential settings. As of November 2025, the German government has allocated substantial resources to promote energy-efficient appliances and smart home solutions, aiming to reduce carbon emissions and enhance energy efficiency. This support not only incentivizes consumers to invest in smart appliances but also encourages manufacturers to innovate and expand their product lines. The collaborative efforts between the government and industry stakeholders are likely to foster a more robust smart home-appliances market, positioning Germany as a leader in smart technology adoption.