Evolving Consumer Preferences

Consumer preferences are evolving within the pharmacy market in Germany, with a growing inclination towards holistic and natural remedies. This trend is reflected in the increasing sales of herbal and homeopathic products, which have seen a growth rate of 8% annually. As consumers become more health-conscious, they are seeking alternatives to traditional pharmaceuticals. Pharmacies are responding by diversifying their product lines to include these options, which may lead to a more competitive landscape. This shift in consumer behavior is likely to influence the overall dynamics of the pharmacy market, fostering innovation and adaptation among providers.

Regulatory Environment and Compliance

The regulatory landscape surrounding the pharmacy market in Germany is becoming increasingly complex, impacting operational practices. Stricter compliance requirements are being enforced, particularly concerning drug safety and patient privacy. In 2025, it is estimated that compliance costs for pharmacies could rise by 15%, necessitating investment in training and technology. While these regulations aim to enhance patient safety, they also pose challenges for smaller pharmacies that may struggle to meet the new standards. Consequently, the evolving regulatory environment is likely to shape the competitive dynamics of the pharmacy market, influencing market entry and operational strategies.

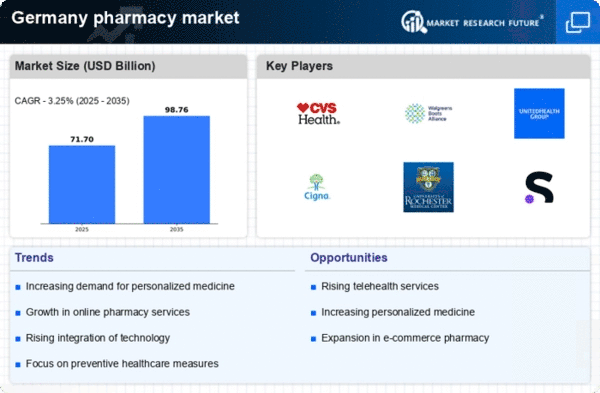

Increased Focus on Preventive Healthcare

The pharmacy market in Germany is witnessing a shift towards preventive healthcare, driven by both consumer awareness and policy initiatives. The German government has been promoting health education and preventive measures, which has led to a rise in the demand for over-the-counter (OTC) products. In 2025, the OTC segment is projected to account for approximately 25% of the total pharmacy market revenue. This focus on prevention is likely to encourage pharmacies to expand their product offerings and services, thereby enhancing their role in the healthcare ecosystem and contributing to market growth.

Rising Demand for Prescription Medications

The pharmacy market in Germany is experiencing a notable increase in the demand for prescription medications. This trend is driven by an aging population, which is projected to reach 23% of the total population by 2030. As chronic diseases become more prevalent, the need for effective pharmaceutical interventions intensifies. In 2024, the total expenditure on prescription drugs in Germany was estimated at €40 billion, reflecting a growth of approximately 5% from the previous year. This rising demand is likely to propel the pharmacy market forward, as pharmacies adapt to meet the needs of a more health-conscious society.

Technological Advancements in Pharmacy Services

Technological innovations are reshaping the pharmacy market in Germany, enhancing service delivery and operational efficiency. The integration of automated dispensing systems and telepharmacy services is becoming increasingly common. In 2025, it is anticipated that over 30% of pharmacies will adopt advanced technology solutions to streamline operations. These advancements not only improve patient safety but also facilitate better medication management. As pharmacies leverage technology to enhance customer experience, the overall growth of the pharmacy market is expected to accelerate, potentially increasing market share by 10% over the next five years.