Advancements in Implant Materials

Innovations in materials science are significantly influencing the orthopedic implant market in Germany. The introduction of biocompatible materials, such as titanium alloys and polymers, enhances the performance and longevity of implants. These advancements not only improve patient outcomes but also reduce the risk of complications associated with traditional materials. Furthermore, the development of smart implants equipped with sensors for monitoring patient recovery is gaining traction. This trend suggests a shift towards personalized medicine in orthopedic care, which could lead to a more efficient healthcare system. The market for advanced materials in orthopedic implants is projected to grow by 6% annually, reflecting the increasing demand for high-quality, durable implants.

Government Initiatives and Funding

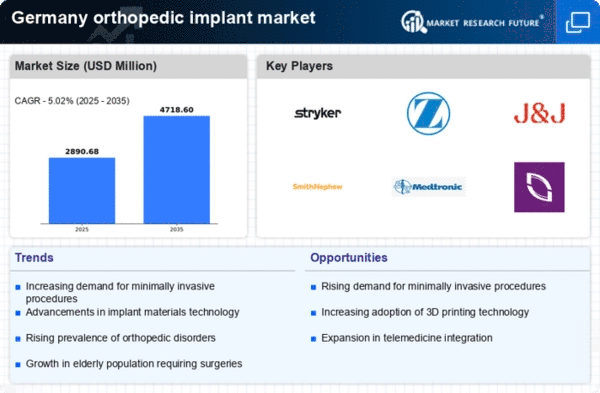

Government initiatives aimed at improving healthcare infrastructure in Germany are positively impacting the orthopedic implant market. The German government has allocated substantial funding to enhance medical facilities and promote research in orthopedic technologies. This support is crucial for the development of innovative implants and surgical techniques. Additionally, public health campaigns focusing on preventive care and early diagnosis of orthopedic conditions are likely to increase patient awareness and treatment rates. As a result, the orthopedic implant market is expected to benefit from increased accessibility to advanced medical care, potentially leading to a market growth rate of 5% annually over the next five years.

Growing Awareness of Sports Injuries

The rising awareness of sports-related injuries among the German population is contributing to the growth of the orthopedic implant market. With an increasing number of individuals participating in sports and physical activities, the incidence of injuries such as ligament tears and fractures is also on the rise. This trend is prompting athletes and active individuals to seek surgical interventions, including the use of orthopedic implants. As a result, the market is likely to see a surge in demand for specialized implants designed for sports injuries. The orthopedic implant market is expected to expand by approximately 4% annually, driven by this growing awareness and the need for effective treatment options.

Integration of Digital Health Solutions

The integration of digital health solutions into orthopedic care is transforming the orthopedic implant market in Germany. Technologies such as telemedicine, electronic health records, and mobile health applications are enhancing patient engagement and streamlining the surgical process. These digital tools facilitate better communication between healthcare providers and patients, leading to improved preoperative assessments and postoperative care. As healthcare providers increasingly adopt these technologies, the orthopedic implant market is likely to benefit from enhanced efficiency and patient satisfaction. The market is projected to grow by 5% annually as digital health solutions become more prevalent in orthopedic practices.

Rising Incidence of Orthopedic Disorders

The orthopedic implant market in Germany is experiencing growth due to the increasing prevalence of orthopedic disorders such as osteoarthritis and osteoporosis. According to recent data, approximately 20% of the German population suffers from some form of musculoskeletal disorder, leading to a higher demand for orthopedic implants. This trend is further exacerbated by lifestyle factors, including sedentary behavior and obesity, which contribute to joint-related issues. As the population ages, the need for joint replacement surgeries is likely to rise, thereby driving the orthopedic implant market. The market is projected to reach a valuation of €3 billion by 2026, indicating a robust growth trajectory fueled by the rising incidence of orthopedic conditions.