Export Opportunities for Organic Products

The organic pesticides market in Germany is poised for growth due to expanding export opportunities for organic agricultural products. Germany is recognized as a leading exporter of organic food within Europe, with exports valued at approximately €1.5 billion in 2025. This demand for organic products abroad encourages local farmers to adopt organic farming practices, including the use of organic pesticides. The organic pesticides market industry is likely to benefit from this trend, as increased exports create a larger market for organic solutions. As international markets continue to grow, the potential for German organic products, supported by organic pesticides, appears promising.

Sustainability Initiatives in Agriculture

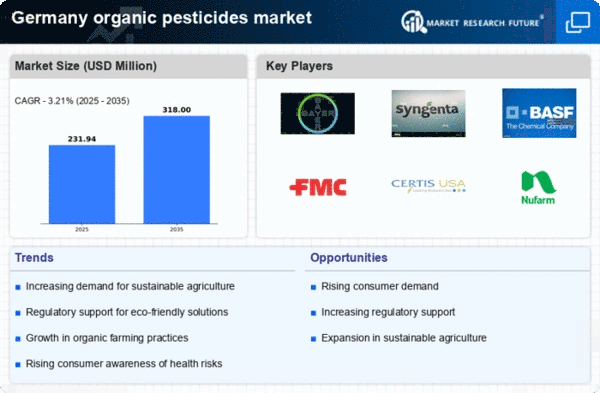

The organic pesticides market in Germany is experiencing a notable boost due to increasing sustainability initiatives within the agricultural sector. Farmers are increasingly adopting practices that align with environmental conservation, which has led to a growing preference for organic pesticides. In 2025, approximately 30% of agricultural land in Germany is expected to be under organic farming practices, reflecting a shift towards sustainable agriculture. This trend is driven by both consumer demand for eco-friendly products and government incentives aimed at reducing chemical pesticide usage. The organic pesticides market industry is thus positioned to benefit from this transition, as more farmers seek alternatives that are less harmful to the ecosystem.

Rising Health Consciousness Among Consumers

Consumer health consciousness is a driving force behind the organic pesticides market in Germany. As awareness of the health risks associated with synthetic pesticides increases, more consumers are opting for organic produce. This shift in consumer behavior is reflected in the organic food market, which is projected to reach €15 billion by 2025. The demand for organic products directly influences the organic pesticides market industry, as farmers seek to meet consumer preferences by utilizing organic pesticides. This trend suggests a long-term growth trajectory for the market, as health-conscious consumers continue to prioritize organic options.

Technological Advancements in Organic Solutions

Technological innovations are playing a crucial role in shaping the organic pesticides market in Germany. Advances in biotechnology and natural product research have led to the development of more effective organic pesticides. For instance, the introduction of biopesticides derived from natural sources has shown efficacy in pest control while minimizing environmental impact. The market for biopesticides is projected to grow at a CAGR of 12% from 2025 to 2030, indicating a robust demand for innovative organic solutions. This growth is likely to enhance the organic pesticides market industry, as farmers increasingly rely on these technologies to improve crop yields sustainably.

Government Policies Promoting Organic Agriculture

The organic pesticides market in Germany is significantly influenced by government policies that promote organic agriculture. The German government has implemented various programs aimed at supporting organic farming, including financial subsidies and educational initiatives for farmers. In 2025, it is estimated that government funding for organic agriculture will reach €200 million, facilitating the transition to organic practices. These policies not only encourage the adoption of organic pesticides but also enhance the overall market landscape. The organic pesticides market industry stands to gain from these supportive measures, as they create a favorable environment for growth and innovation.