Rise of Functional Foods

The trend toward functional foods significantly impacts the medicinal mushroom market in Germany. Consumers are increasingly looking for foods that provide health benefits beyond basic nutrition. This shift is evident in the growing popularity of mushroom-infused products, such as coffee and snacks, which are marketed for their health-enhancing properties. The functional food segment is expected to grow by 12% annually, with medicinal mushrooms playing a pivotal role in this expansion. As consumers prioritize health and wellness, the incorporation of medicinal mushrooms into everyday diets is likely to become more mainstream, further driving market growth.

Growing Consumer Awareness

The medicinal mushroom market in Germany is experiencing a notable surge in consumer awareness regarding health and wellness. As individuals increasingly seek natural remedies, the demand for products derived from medicinal mushrooms has escalated. This trend is reflected in a reported growth rate of approximately 15% annually in the sector. Consumers are becoming more informed about the potential health benefits of mushrooms such as reishi, lion's mane, and cordyceps, which are believed to enhance immunity and cognitive function. This heightened awareness is driving sales across various channels, including health food stores and online platforms, thereby contributing to the overall expansion of the medicinal mushroom market.

Focus on Sustainable Sourcing

Sustainability is becoming a key driver in the medicinal mushroom market in Germany. Consumers are increasingly concerned about the environmental impact of their purchases, leading to a demand for sustainably sourced products. Companies that prioritize eco-friendly practices, such as organic farming and responsible harvesting, are likely to gain a competitive edge. This focus on sustainability is not only appealing to environmentally conscious consumers but also aligns with broader trends in the food industry. As a result, the medicinal mushroom market is expected to see a growth rate of 8% as more brands adopt sustainable practices, thereby attracting a loyal customer base.

Increased Online Sales Channels

The medicinal mushroom market in Germany is benefiting from the rise of e-commerce platforms. With more consumers turning to online shopping for health products, companies are increasingly establishing a digital presence to reach a broader audience. This shift is reflected in a 20% increase in online sales of medicinal mushroom products over the past year. The convenience of online shopping, coupled with the ability to access a wider variety of products, is attracting consumers who may not have previously considered these options. As e-commerce continues to grow, it is expected to play a crucial role in the expansion of the medicinal mushroom market.

Regulatory Support for Natural Products

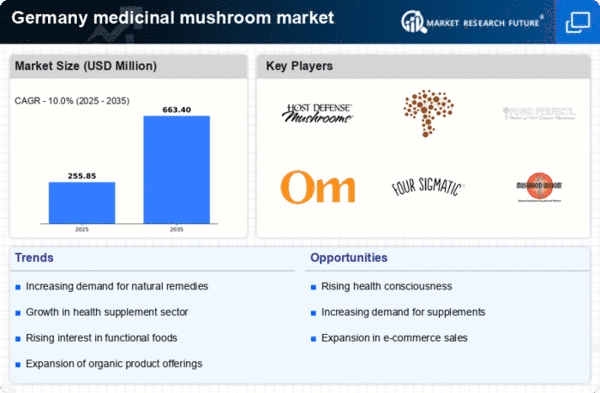

In Germany, the regulatory landscape is becoming increasingly favorable for the medicinal mushroom market. The government has implemented policies that support the use of natural health products, which encourages manufacturers to innovate and expand their offerings. This regulatory support is crucial as it not only ensures product safety but also boosts consumer confidence. As a result, the market is projected to grow by 10% over the next five years, driven by the introduction of new products that comply with these regulations. This environment fosters a competitive market where companies can thrive, ultimately benefiting consumers seeking natural health solutions.