Evolving Regulatory Landscape

The enterprise risk-management market in Germany is significantly influenced by the evolving regulatory landscape. Regulatory bodies are continuously updating compliance requirements, compelling organizations to adapt their risk management practices accordingly. This dynamic environment necessitates the implementation of comprehensive risk frameworks to ensure compliance with local and international regulations. The financial sector, in particular, faces stringent regulations, which has led to an increased allocation of resources towards risk management solutions. It is anticipated that compliance-related expenditures will constitute around 25% of the total enterprise risk-management market by 2025, highlighting the importance of this driver.

Integration of Advanced Analytics

The integration of advanced analytics into risk management processes is transforming the enterprise risk-management market in Germany. Organizations are leveraging data analytics to gain insights into potential risks and enhance decision-making capabilities. This trend is particularly relevant as businesses seek to optimize their risk assessment methodologies. The use of predictive analytics and machine learning algorithms is becoming commonplace, allowing companies to proactively identify and mitigate risks. It is projected that the analytics segment will grow by approximately 15% annually, indicating a strong shift towards data-driven risk management solutions in the enterprise risk-management market.

Rising Awareness of Operational Risks

There is a growing awareness of operational risks within the enterprise risk-management market in Germany. Organizations are increasingly recognizing that operational disruptions can have severe financial implications. This awareness is driving the need for comprehensive risk assessments that encompass various operational aspects. Companies are investing in training and development programs to enhance their employees' understanding of risk management practices. It is estimated that operational risk management solutions will account for nearly 20% of the enterprise risk-management market by 2026, underscoring the significance of this driver in shaping market dynamics.

Increased Focus on Cybersecurity Risks

As digital transformation accelerates, the enterprise risk-management market in Germany is witnessing a heightened focus on cybersecurity risks. Organizations are becoming more aware of the vulnerabilities associated with digital operations, leading to a surge in investments in cybersecurity measures. The German government has implemented various initiatives to bolster cybersecurity, which further emphasizes the importance of integrating robust risk management strategies. It is estimated that the cybersecurity segment within the enterprise risk-management market could account for over 30% of total market revenue by 2026, reflecting the critical nature of this driver.

Growing Demand for Risk Mitigation Solutions

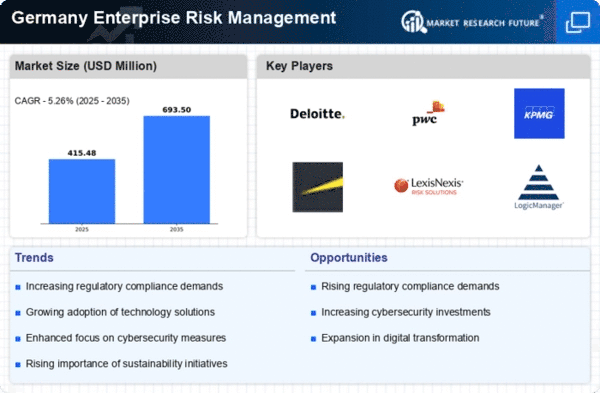

The The enterprise risk management market in Germany is experiencing a notable increase in demand for risk mitigation solutions. Organizations are increasingly recognizing the necessity of identifying and managing potential risks to safeguard their assets and reputation. This trend is driven by the rising complexity of business operations and the need for comprehensive risk assessments. According to recent data, the market is projected to grow at a CAGR of approximately 8.5% over the next five years. Companies are investing in advanced risk management frameworks to enhance their resilience against unforeseen events, thereby propelling the enterprise risk-management market forward.