Increasing Health Awareness

The empty capsule market in Germany is experiencing growth driven by a rising awareness of health and wellness among consumers. As individuals become more conscious of their dietary choices, there is a notable shift towards supplements and nutraceuticals. This trend is reflected in the increasing demand for vegetarian and plant-based capsules, which are perceived as healthier alternatives. In 2025, the market for dietary supplements in Germany is projected to reach approximately €3 billion, indicating a robust interest in health-oriented products. Consequently, the empty capsule market is likely to benefit from this heightened focus on health, as manufacturers adapt their offerings to meet consumer preferences for natural and organic ingredients.

Consumer Preference for Customization

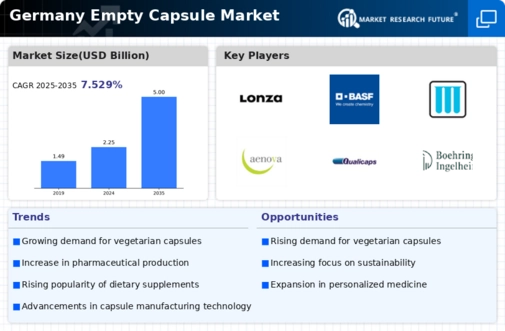

The empty capsule market in Germany is increasingly influenced by consumer preferences for personalized health solutions. As individuals seek tailored dietary supplements that address specific health concerns, the demand for customizable empty capsules is on the rise. This trend is evident in the growing popularity of bespoke supplement formulations, which often require unique capsule designs and sizes. Market analysts suggest that this shift towards personalization could lead to a growth rate of approximately 7% in the empty capsule market over the next few years. Manufacturers are likely to respond by investing in flexible production capabilities to meet the evolving demands of consumers, thereby enhancing their position in the competitive landscape.

Regulatory Support for Nutraceuticals

The empty capsule market in Germany is positively impacted by supportive regulatory frameworks that promote the use of nutraceuticals and dietary supplements. The German government has established guidelines that facilitate the development and marketing of health-related products, thereby encouraging investment in the empty capsule market. This regulatory environment not only fosters innovation but also enhances consumer trust in the safety and efficacy of these products. As a result, the market for empty capsules is expected to expand, with projections indicating a potential increase in market size by 5% over the next few years. This supportive landscape is essential for the growth of the empty capsule market.

Rising E-commerce Sales of Health Products

The empty capsule market in Germany is witnessing a surge in e-commerce sales, particularly for health and wellness products. The convenience of online shopping has led to an increase in consumer access to a wide range of dietary supplements and nutraceuticals, which often utilize empty capsules for delivery. In 2025, e-commerce sales in the health product sector are anticipated to exceed €1 billion, reflecting a shift in consumer purchasing behavior. This trend is likely to drive demand for empty capsules, as online retailers seek to offer diverse product lines that cater to health-conscious consumers. The growth of e-commerce is thus a significant driver for the empty capsule market.

Technological Advancements in Capsule Production

Technological innovations in the production of empty capsules are significantly influencing the empty capsule market in Germany. Advanced manufacturing techniques, such as the use of non-gelatin materials and improved encapsulation processes, are enhancing the quality and efficiency of capsule production. These advancements not only reduce production costs but also allow for the creation of customized capsules that cater to specific consumer needs. As a result, the market is witnessing an increase in the availability of innovative capsule formulations, which could potentially lead to a market growth rate of around 6% annually. This technological evolution is crucial for manufacturers aiming to maintain competitiveness in the dynamic empty capsule market.