Increasing Geriatric Population

The demographic shift towards an aging population in Germany is a key driver for the dental biomaterials market. As the elderly population grows, there is a corresponding rise in dental issues such as tooth loss and periodontal disease, necessitating the use of advanced biomaterials for effective treatment. It is estimated that by 2030, over 25% of the German population will be aged 65 and above, leading to increased demand for dental implants and prosthetics. This trend is likely to propel the dental biomaterials market, as healthcare providers seek innovative solutions to cater to the specific needs of older patients.

Advancements in Material Science

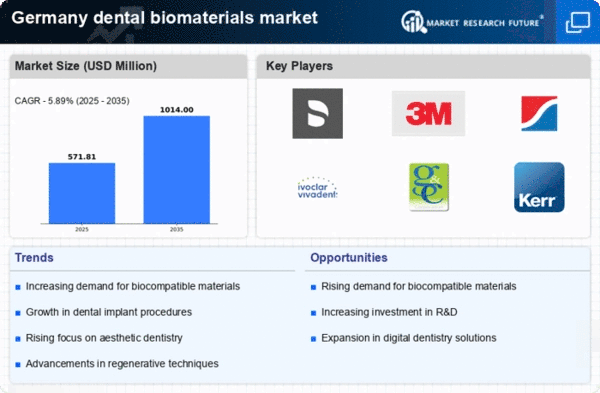

Innovations in material science are significantly impacting the dental biomaterials market. The development of new biomaterials with enhanced properties, such as biocompatibility and durability, is crucial for improving patient outcomes. For instance, the introduction of bioactive glass and advanced polymers is revolutionizing restorative dentistry. These materials not only promote healing but also integrate well with natural tissues. In Germany, the market for advanced dental biomaterials is expected to grow at a CAGR of around 5% over the next five years, driven by ongoing research and development efforts aimed at creating superior dental solutions.

Growing Awareness of Oral Health

There is a notable increase in awareness regarding oral health among the German population, which is positively influencing the dental biomaterials market. Educational campaigns and initiatives by dental associations are encouraging individuals to prioritize dental care, leading to higher demand for restorative and preventive treatments. This heightened awareness is reflected in the rising number of dental visits and procedures, which in turn drives the need for advanced biomaterials. The market is expected to see a growth rate of approximately 4% annually as more individuals seek quality dental care and materials that ensure long-lasting results.

Rising Demand for Aesthetic Dentistry

The increasing emphasis on aesthetic appeal in dental treatments is driving the dental biomaterials market. Patients in Germany are increasingly seeking solutions that not only restore function but also enhance the visual aspect of their smiles. This trend is reflected in the growing popularity of materials such as ceramics and composites, which offer superior aesthetic qualities. According to recent data, the aesthetic dentistry segment is projected to account for approximately 30% of the overall dental biomaterials market by 2026. This shift towards aesthetic solutions is prompting manufacturers to innovate and develop new biomaterials that meet these consumer preferences, thereby expanding the market.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is reshaping the dental biomaterials market. Innovations such as 3D printing and digital dentistry are streamlining the production and application of dental biomaterials, enhancing precision and efficiency. In Germany, dental clinics are increasingly adopting these technologies, which not only improve patient outcomes but also reduce operational costs. The market for 3D-printed dental biomaterials is anticipated to grow significantly, with projections indicating a potential increase of 20% by 2027. This technological shift is likely to foster a more competitive landscape, encouraging further advancements in biomaterial development.