Global Market Trends

The Germany bio fertilizers market is also influenced by global trends towards sustainable agriculture. As international markets increasingly favor organic products, German farmers are motivated to adopt bio fertilizers to remain competitive. The germany bio fertilizers market is projected to reach USD 500 billion by 2027, indicating a substantial opportunity for German producers. This trend encourages local farmers to invest in bio fertilizers, aligning their practices with global standards and consumer preferences. The interconnectedness of the global market suggests that the growth of the bio fertilizers sector in Germany is not only a local phenomenon but also part of a larger movement towards sustainable agricultural practices worldwide.

Rising Consumer Awareness

The increasing awareness among consumers regarding the benefits of organic farming is a pivotal driver for the Germany bio fertilizers market. As consumers become more informed about the adverse effects of synthetic fertilizers on health and the environment, there is a noticeable shift towards organic alternatives. This trend is reflected in the growing demand for organic produce, which has seen a rise of approximately 20% in recent years. Consequently, farmers are compelled to adopt bio fertilizers to meet consumer preferences, thereby enhancing their market competitiveness. The Germany bio fertilizers market is thus experiencing a transformation, as producers seek to align their practices with consumer expectations for sustainability and health-conscious choices.

Technological Innovations

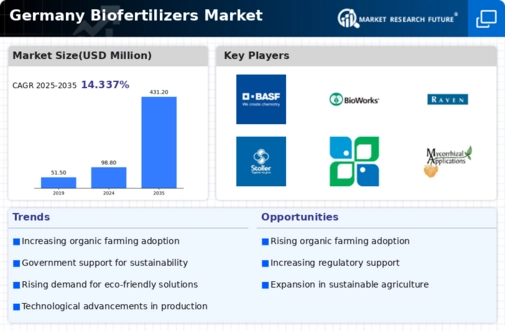

Technological advancements in the production and application of bio fertilizers are driving growth in the Germany bio fertilizers market. Innovations such as microbial inoculants and slow-release formulations enhance the efficiency and effectiveness of bio fertilizers, making them more appealing to farmers. The integration of precision agriculture technologies allows for targeted application, optimizing resource use and minimizing waste. As a result, the market for bio fertilizers is projected to grow at a compound annual growth rate (CAGR) of around 10% over the next five years. These technological developments not only improve crop yields but also contribute to sustainable farming practices, reinforcing the position of bio fertilizers in the agricultural landscape of Germany.

Regulatory Framework and Incentives

The German government has established a robust regulatory framework that promotes the use of bio fertilizers, significantly influencing the Germany bio fertilizers market. Policies aimed at reducing chemical inputs in agriculture, such as the Fertilizer Ordinance, encourage farmers to transition to organic practices. Additionally, financial incentives and subsidies for organic farming practices have been introduced, making bio fertilizers more accessible to farmers. This regulatory support is crucial, as it not only fosters a conducive environment for the adoption of bio fertilizers but also aligns with Germany's broader sustainability goals. The market is likely to expand as more farmers take advantage of these incentives, thereby contributing to the growth of the bio fertilizers sector.

Environmental Sustainability Concerns

Growing concerns regarding environmental sustainability are propelling the Germany bio fertilizers market forward. The adverse effects of conventional fertilizers on soil health, water quality, and biodiversity have prompted both consumers and policymakers to advocate for more sustainable agricultural practices. Bio fertilizers, which enhance soil fertility and promote ecological balance, are increasingly viewed as a viable solution to these environmental challenges. The market is responding to this demand, with a notable increase in the adoption of bio fertilizers among farmers seeking to mitigate their environmental impact. This shift not only aligns with Germany's commitment to sustainable development but also positions the bio fertilizers market as a key player in the transition towards eco-friendly agriculture.